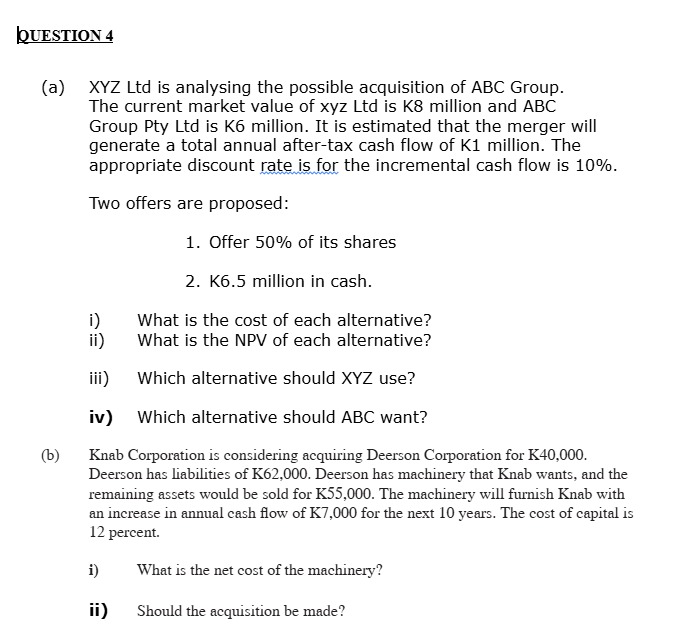

Question: QUESTION 4 ( a ) XYZ Ltd is analysing the possible acquisition of ( A B C ) Group. The current market value

QUESTION a XYZ Ltd is analysing the possible acquisition of A B C Group. The current market value of xyz Ltd is K million and ABC Group Pty Ltd is K million. It is estimated that the merger will generate a total annual aftertax cash flow of K million. The appropriate discount rate is for the incremental cash flow is Two offers are proposed: Offer of its shares K million in cash. i What is the cost of each alternative? ii What is the NPV of each alternative? iii Which alternative should XYZ use? iv Which alternative should A B C want? b Knab Corporation is considering acquiring Deerson Corporation for K Deerson has liabilities of K Deerson has machinery that Knab wants, and the remaining assets would be sold for K The machinery will furnish Knab with an increase in annual cash flow of mathrmK for the next years. The cost of capital is percent. i What is the net cost of the machinery? ii Should the acquisition be made?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock