Question: Question 4 a) You have found the perfect burial plot. Of course, you don't plan to need it for 60 years. The plot costs $12,000

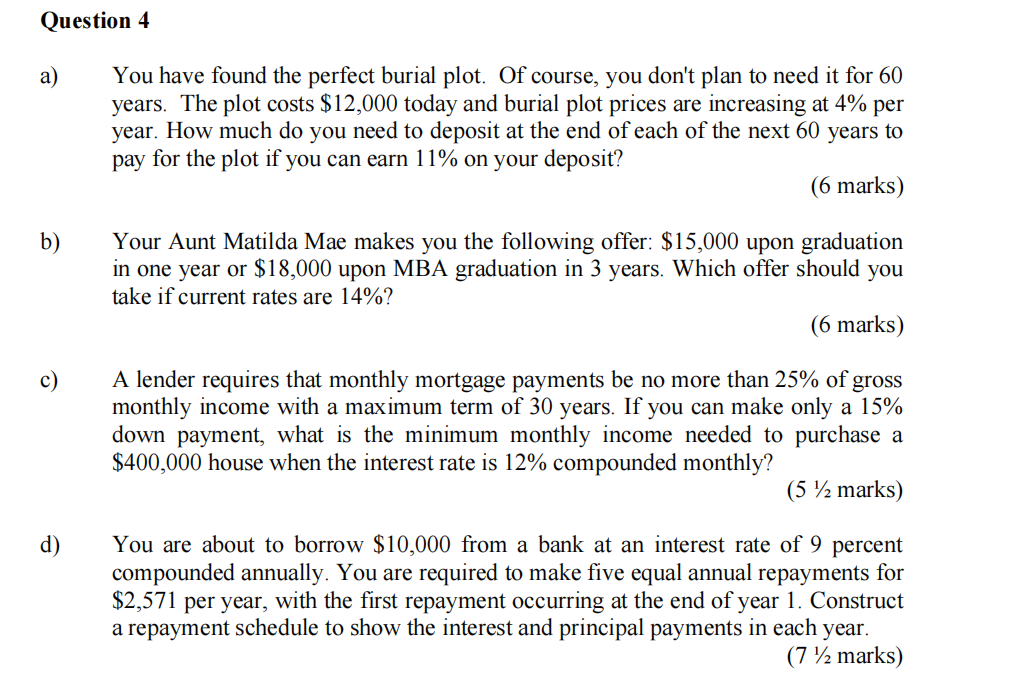

Question 4 a) You have found the perfect burial plot. Of course, you don't plan to need it for 60 years. The plot costs $12,000 today and burial plot prices are increasing at 4% per year. How much do you need to deposit at the end of each of the next 60 years to pay for the plot if you can earn 11% on your deposit? (6 marks) b) Your Aunt Matilda Mae makes you the following offer: $15,000 upon graduation in one year or $18,000 upon MBA graduation in 3 years. Which offer should you take if current rates are 14%? (6 marks) c) A lender requires that monthly mortgage payments be no more than 25% of gross monthly income with a maximum term of 30 years. If you can make only a 15% down payment, what is the minimum monthly income needed to purchase a $400,000 house when the interest rate is 12% compounded monthly? (5 %2 marks) d) You are about to borrow $10,000 from a bank at an interest rate of 9 percent compounded annually. You are required to make five equal annual repayments for $2,571 per year, with the first repayment occurring at the end of year 1. Construct a repayment schedule to show the interest and principal payments in each year. (7 72 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts