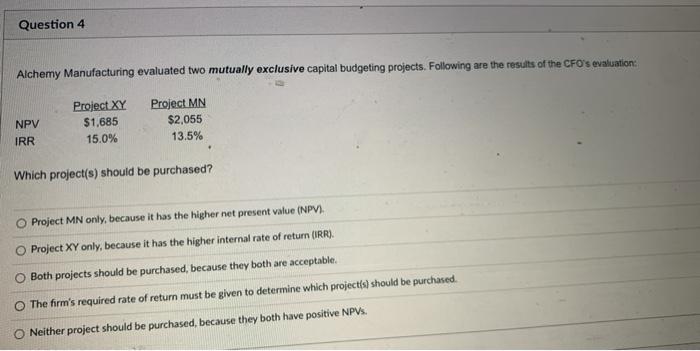

Question: Question 4 Alchemy Manufacturing evaluated two mutually exclusive capital budgeting projects. Following are the results of the CFO's evaluation: NPV IRR Project XY $1,685 15.0%

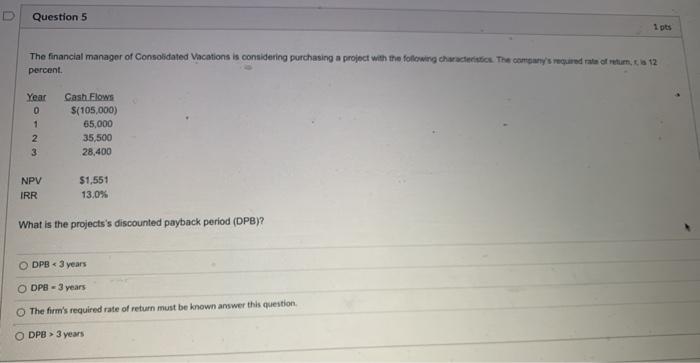

Question 4 Alchemy Manufacturing evaluated two mutually exclusive capital budgeting projects. Following are the results of the CFO's evaluation: NPV IRR Project XY $1,685 15.0% Project MN $2,055 13.5% . Which project(s) should be purchased? Project MN only, because it has the higher net present value (NPV). Project XY only, because it has the higher internal rate of return (IRR). Both projects should be purchased, because they both are acceptable. The firm's required rate of return must be given to determine which project(s) should be purchased. Neither project should be purchased, because they both have positive NPVS. D Question 5 The financial manager of Consolidated Vacations is considering purchasing a project with the following characteristics. The comany's moured rate of retum.ca 12 percent Year 0 1 2 3 Cash Flows $(105,000) 65,000 35,500 28,400 NPV IRR $1,551 13.0% What is the projects's discounted payback period (DPB)? DPB 3 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts