Question: QUESTION 4 Ann got a 30 year Fully Amortizing FRM for $1,500,000 at an annual interest rate of 4.25% compounded monthly, with monthly payments. After

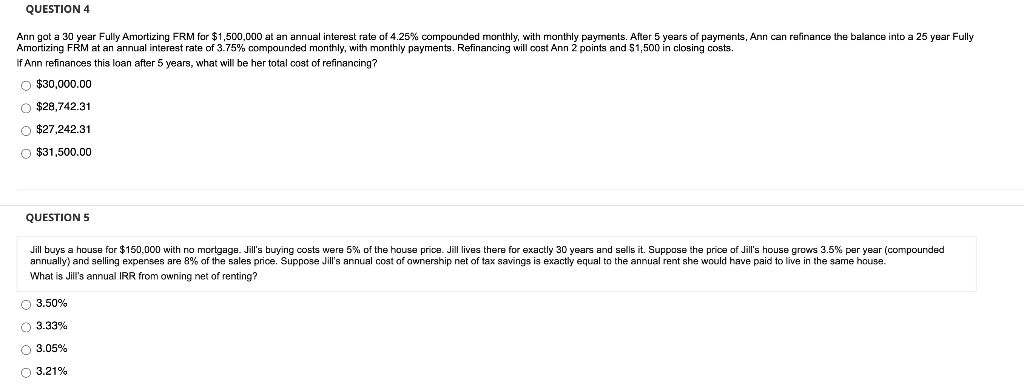

QUESTION 4 Ann got a 30 year Fully Amortizing FRM for $1,500,000 at an annual interest rate of 4.25% compounded monthly, with monthly payments. After 5 years of payments, Ann can refinance the balance into a 25 year Fully Amortizing FRM at an annual interest rate of 3.75% compounded monthly, with monthly payments. Refinancing will cost Ann 2 points and $1,500 in closing costs. If Ann refinances this loan after 5 years, what will be her total cost of refinancing? $30,000.00 $28,742.31 $27.242.31 $31,500.00 QUESTIONS Jill buys a house for $150,000 with no mortgage. Jill's buying costs were 5% of the house price. Jill lives there for exactly 30 years and sells it. Suppose the price of Jill's house grows 3.5% per year (compounded annually) and selling expenses are 8% of the sales price. Suppose Jill's annual cost of ownership net of tax savings is exactly equal to the annual rent she would have paid to live in the same house. What is Jill's annual IRR from owning net of renting? 3.50% 3.33% 3.05% 3.21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts