Question: Question 4 AR company is considering a new three-year project to build on the land they bought at 1 million dollars 3 year ago. The

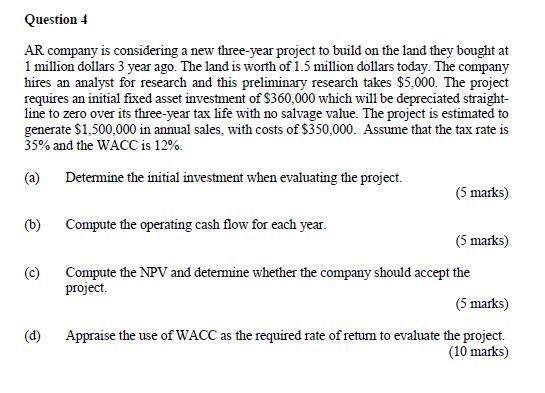

Question 4 AR company is considering a new three-year project to build on the land they bought at 1 million dollars 3 year ago. The land is worth of 1.5 million dollars today. The company hires an analyst for research and this preliminary research takes $5.000. The project requires an initial fixed asset investment of $360,000 which will be depreciated straight- line to zero over its three-year tax life with no salvage value. The project is estimated to generate $1,500,000 in annual sales, with costs of $350,000. Assume that the tax rate is 35% and the WACC is 12%. (a) Determine the initial investment when evaluating the project. (5 marks) (6) Compute the operating cash flow for each year. (5 marks) (c) Compute the NPV and determine whether the company should accept the project. (5 marks) (d) Appraise the use of WACC as the required rate of retum to evaluate the project. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts