Question: Question #4: Asset Allocation [20 Points] Suppose that Elena has a choice in investing her vast funds between two assets: Sturm Ruger & Company Inc.,

![Question \\#4: Asset Allocation [20 Points] Suppose that Elena has a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffb0740710c_88366ffb07350479.jpg)

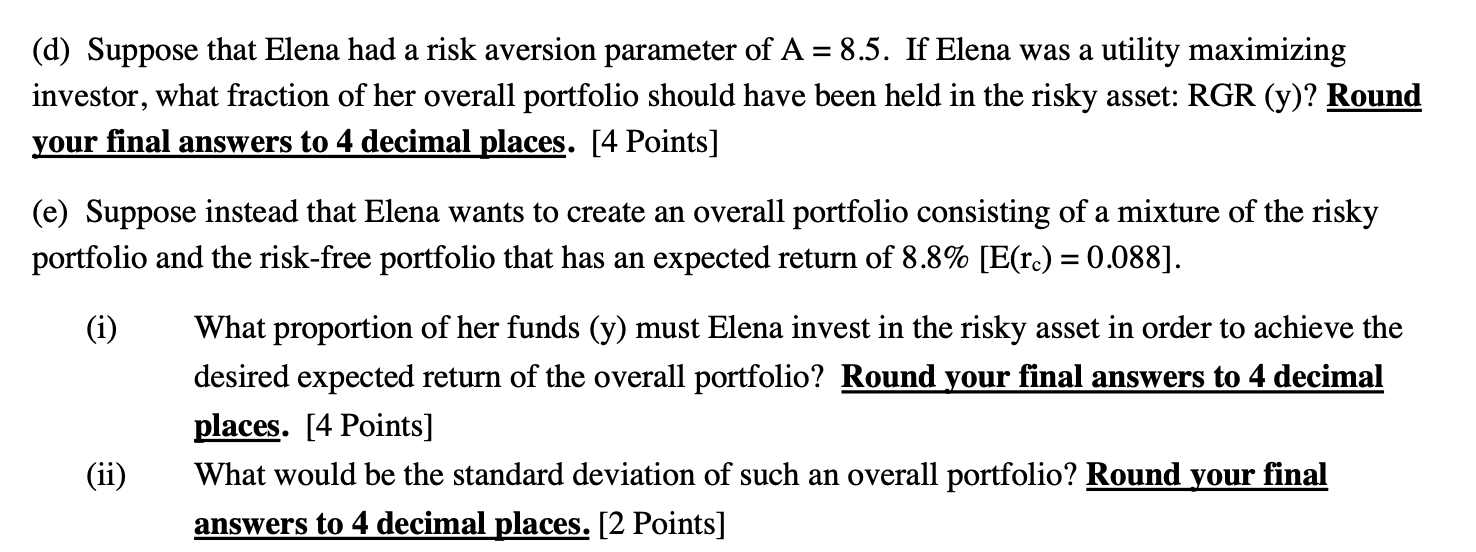

Question \\#4: Asset Allocation [20 Points] Suppose that Elena has a choice in investing her vast funds between two assets: Sturm Ruger \\& Company Inc., the risky asset (Ticker Symbol: RGR) or in treasury-bills, the risk-free asset. (a) Suppose initially Elena constructs an investment portfolio where \72 of her funds are invested in RGR and \28 of her funds are invested in the treasury bills. Calculate the expected return \\( \\mathrm{E}\\left(\\mathrm{r}_{\\mathrm{c}}\ ight) \\) and standard deviation \\( \\left(\\sigma_{\\mathrm{c}}\ ight) \\) of the overall portfolio. Round your final answers to 4 decimal places. [4 Points] (b) Use your answers from Part (a) to calculate the Sharpe ratio of the overall portfolio. Round your final answer to 4 decimal places. [2 Points] (c) Draw the capital allocation line (CAL) for Elena's portfolio. Show the position of Elena's overall portfolio (Found in Part (a) on the CAL (label this point, \"A\" on your graph). [4 Points] (d) Suppose that Elena had a risk aversion parameter of \\( A=8.5 \\). If Elena was a utility maximizing investor, what fraction of her overall portfolio should have been held in the risky asset: RGR (y)? Round your final answers to 4 decimal places. [ 4 Points] (e) Suppose instead that Elena wants to create an overall portfolio consisting of a mixture of the risky portfolio and the risk-free portfolio that has an expected return of \8.8. (i) What proportion of her funds (y) must Elena invest in the risky asset in order to achieve the desired expected return of the overall portfolio? Round your final answers to 4 decimal places. [4 Points] (ii) What would be the standard deviation of such an overall portfolio? answers to 4 decimal places. [ 2 Points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts