Question: Question 4 Assume today is 1st August. British Machine Plc, a leading British-based international engineering company, is expecting the following transactions in the next

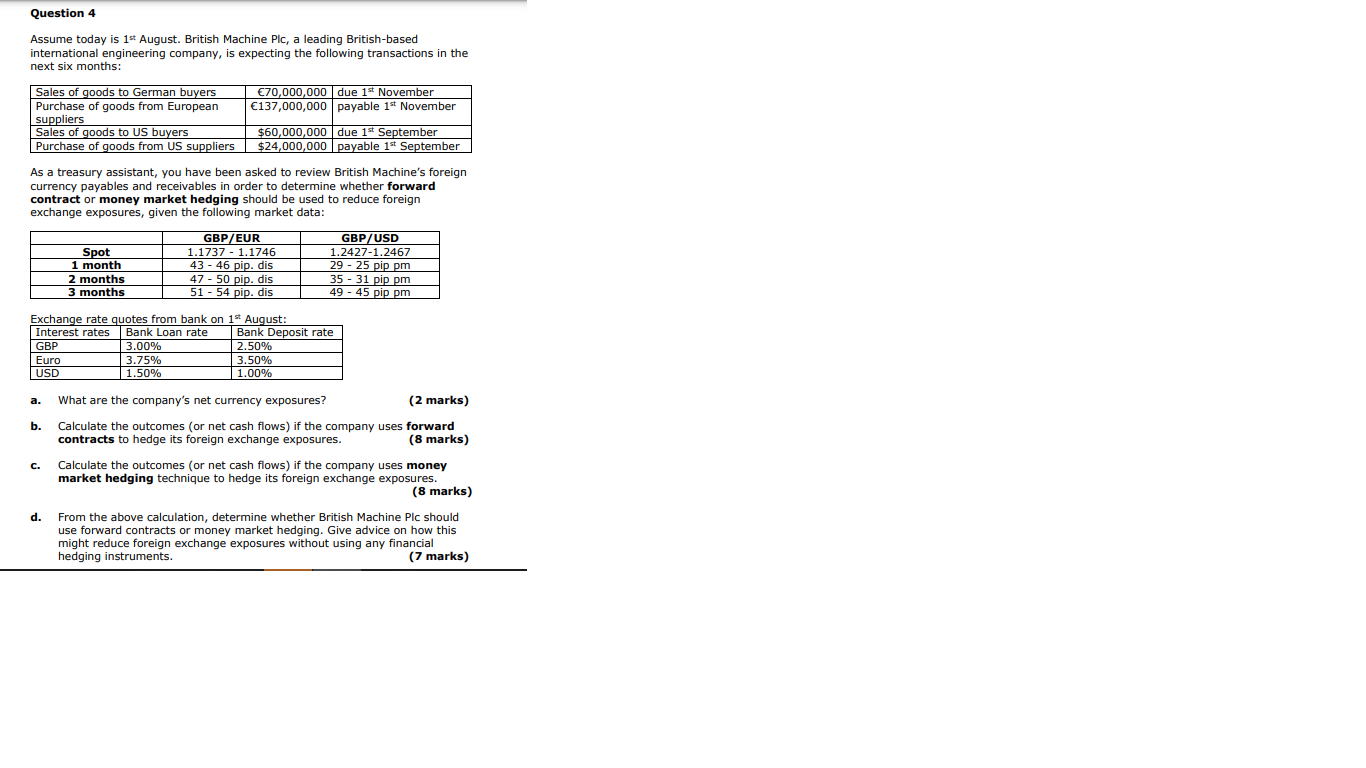

Question 4 Assume today is 1st August. British Machine Plc, a leading British-based international engineering company, is expecting the following transactions in the next six months: Sales of goods to German buyers Purchase of goods from European suppliers Sales of goods to US buyers Purchase of goods from US suppliers 70,000,000 due 1st November 137,000,000 payable 1st November $60,000,000 due 1st September $24,000,000 payable 1st September As a treasury assistant, you have been asked to review British Machine's foreign currency payables and receivables in order to determine whether forward contract or money market hedging should be used to reduce foreign exchange exposures, given the following market data: GBP/EUR 1.1737 1.1746 43-46 pip. dis 47-50 pip. dis 51 - 54 pip. dis Spot 1 month 2 months 3 months Exchange rate quotes from bank on 1st August: GBP/USD 1.2427-1.2467 29-25 pip pm 35-31 pip pm 49-45 pip pm Interest rates Bank Loan rate Bank Deposit rate GBP 3.00% 2.50% Euro 3.75% 3.50% USD 1.50% 1.00% a. What are the company's net currency exposures? b. (2 marks) C. d. Calculate the outcomes (or net cash flows) if the company uses forward contracts to hedge its foreign exchange exposures. (8 marks) Calculate the outcomes (or net cash flows) if the company uses money market hedging technique to hedge its foreign exchange exposures. (8 marks) From the above calculation, determine whether British Machine Plc should use forward contracts or money market hedging. Give advice on how this might reduce foreign exchange exposures without using any financial hedging instruments. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Heres an analysis of British Machine Plcs foreign exchange exposures and a comparison of forward contract and money market hedging a What are the companys net currency exposures 2 marks British Machin... View full answer

Get step-by-step solutions from verified subject matter experts