Question: QUESTION 4 Bank A pays 2% interest compounded annually on deposits, while Bank B pays 1.75% compounded daily. What would be the effective annual rate

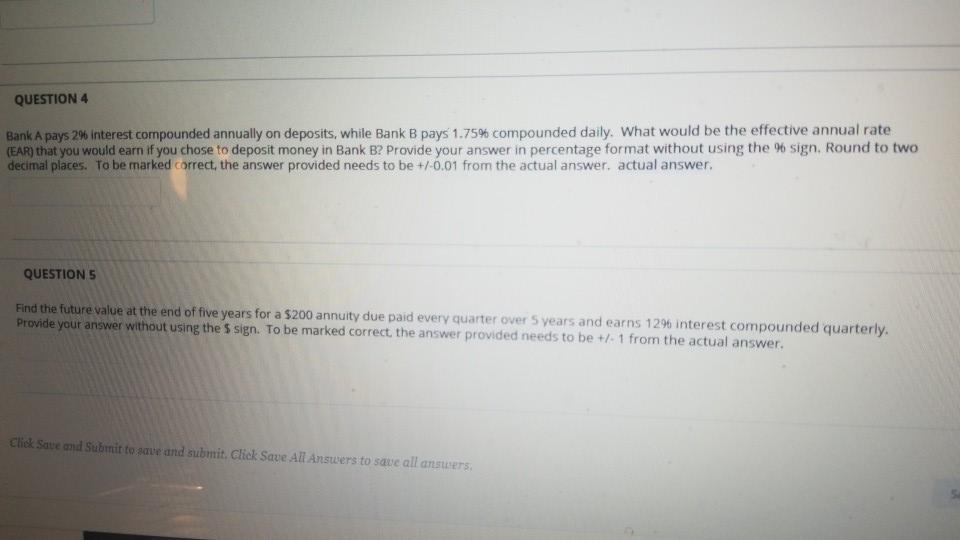

QUESTION 4 Bank A pays 2% interest compounded annually on deposits, while Bank B pays 1.75% compounded daily. What would be the effective annual rate (EAR) that you would earn if you chose to deposit money in Bank B? Provide your answer in percentage format without using the % sign. Round to two decimal places. To be marked correct, the answer provided needs to be +/-0.01 from the actual answer, actual answer. QUESTION 5 Find the future value at the end of five years for a $200 annuity due paid every quarter over 5 years and earns 129 interest compounded quarterly. Provide your answer without using the sign. To be marked correct the answer provided needs to be +/- 1 from the actual answer, Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts