Question: Question (4): BMG Inc. uses the weighted average method in its process costing system. The following data concern the operations of the company's first processing

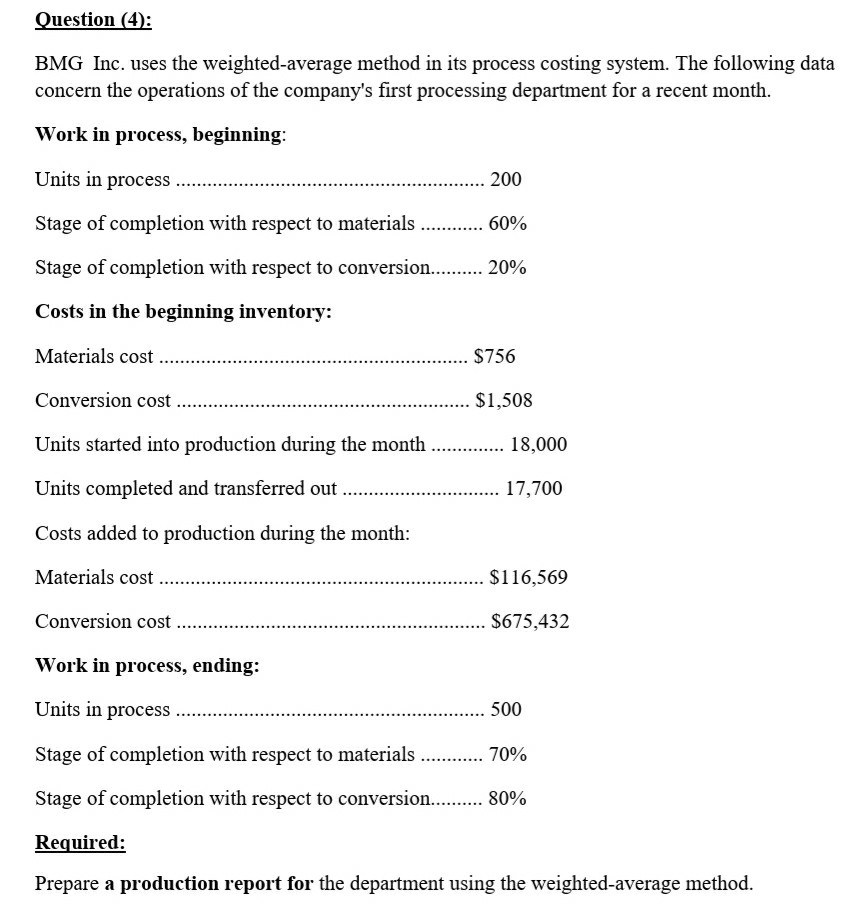

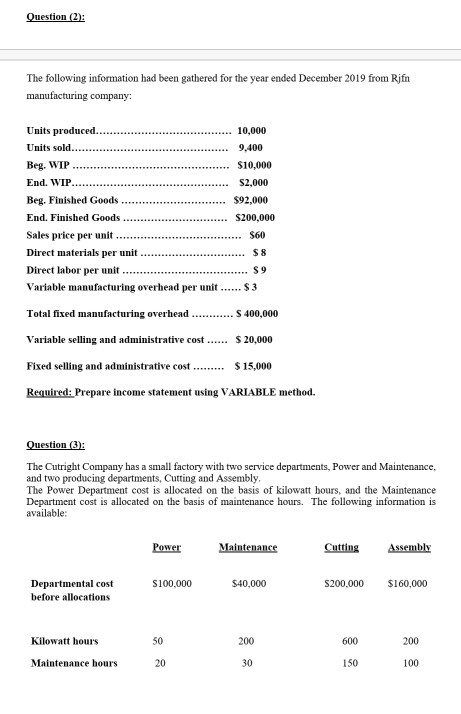

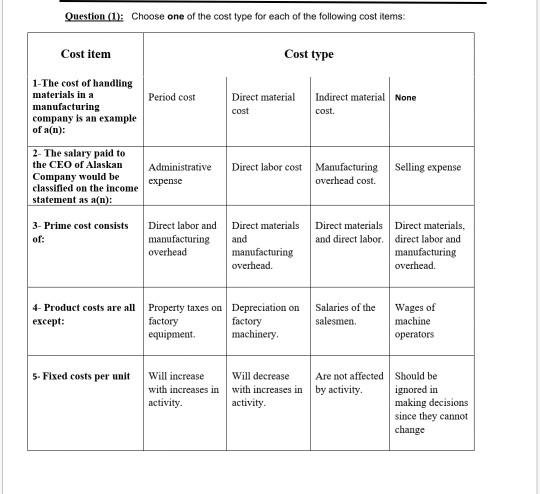

Question (4): BMG Inc. uses the weighted average method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Work in process, beginning: Units in process ..... 200 Stage of completion with respect to materials ...... 60% Stage of completion with respect to conversion......... 20% Costs in the beginning inventory: Materials cost ........ $756 Conversion cost $1,508 Units started into production during the month ............. 18,000 Units completed and transferred out. 17,700 Costs added to production during the month: Materials cost .... ..... $116,569 Conversion cost $675,432 Work in process, ending: Units in process 500 Stage of completion with respect to materials .......... 70% Stage of completion with respect to conversion. Required: Prepare a production report for the department using the weighted average method. Question (2): The following information had been gathered for the year ended December 2019 from Rjfn manufacturing company: S8 Units produced 10,000 Units sold. 9,400 Beg. WIP $10,000 End, WIP. $2,000 Beg. Finished Goods $92,000 End. Finished Goods $200,000 Sales price per unit $60 Direct materials per unit Direct labor per unit $ 9 Variable manufacturing overhead per unit $3 Total fixed manufacturing overhead .... S 400,000 Variable selling and administrative cost ...... $ 20,000 Fixed selling and administrative cost $ 15,000 Required: Prepare income statement using VARIABLE method. Question (3) The Cutright Company has a small factory with two service departments, Power and Maintenance, and two producing departments, Cutting and Assembly, The Power Department cost is allocated on the basis of kilowatt hours, and the Maintenance Department cost is allocated on the basis of maintenance hours. The following information is available: Power Maintenance Cutting Assembly $100,000 $40,000 S200.000 $160,000 Departmental cost before allocations Kilowatt hour's 50 200 600 200 Maintenance hours 20 30 150 100 Question (1): Choose one of the cost type for each of the following cost items: Cost item Cost type Period cost 1-The cost of handling materials in a manufacturing company is an example of a(n): Direct material cost Indirect material None cost. 2- The salary paid to the CEO of Alaskan Company would be classified on the income statement as a(m): Administrative expense Direct labor cost Manufacturing Selling expense overhead cost. 3- Prime cost consists of: Direct labor and manufacturing overhead Direct materials and manufacturing overhead. Direct materials Direct materials, and direct labor direct labor and manufacturing overhead. 4- Product costs are all Property taxes on Depreciation on except: factory factory equipment. machinery Salaries of the salesmen. Wages of machine operators 5- Fixed costs per unit Will increase Will decrease Are not affected should be with increases in with increases in by activity ignored in activity. activity making decisions since they cannot change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts