Question: QUESTION 4 Calculate alpha for the Small Cap portfolio. Use the risk free rate and SP500 return shown at the beginning of the quiz. QUESTION

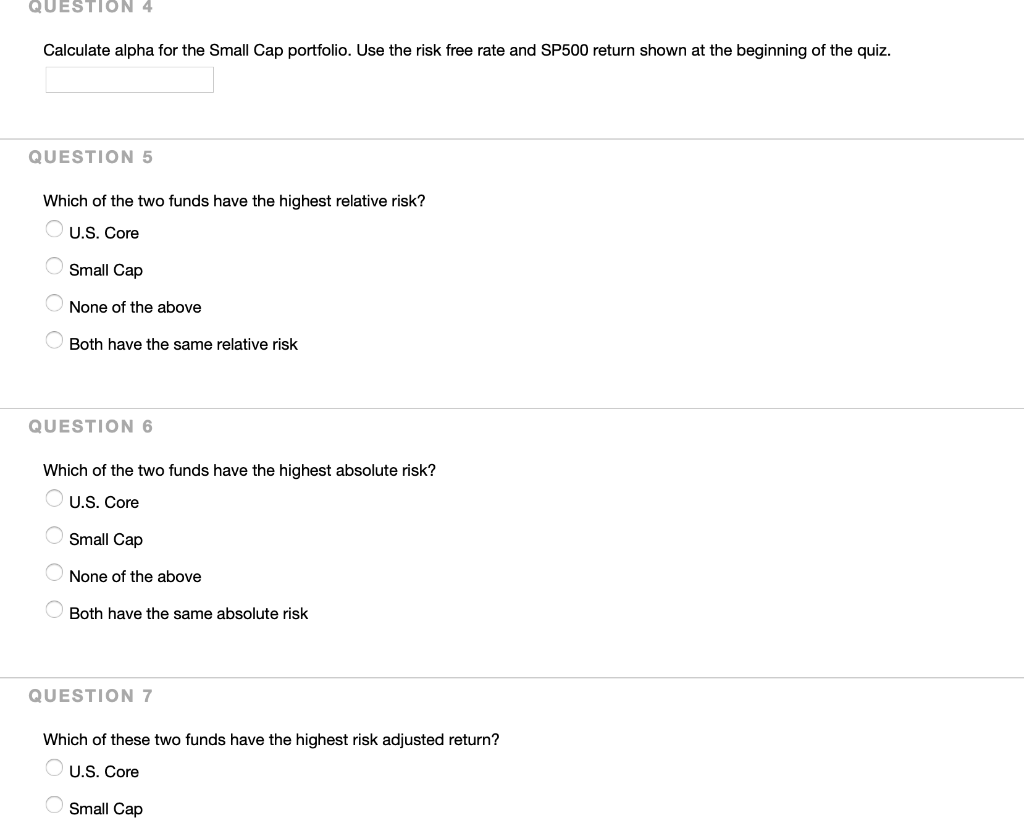

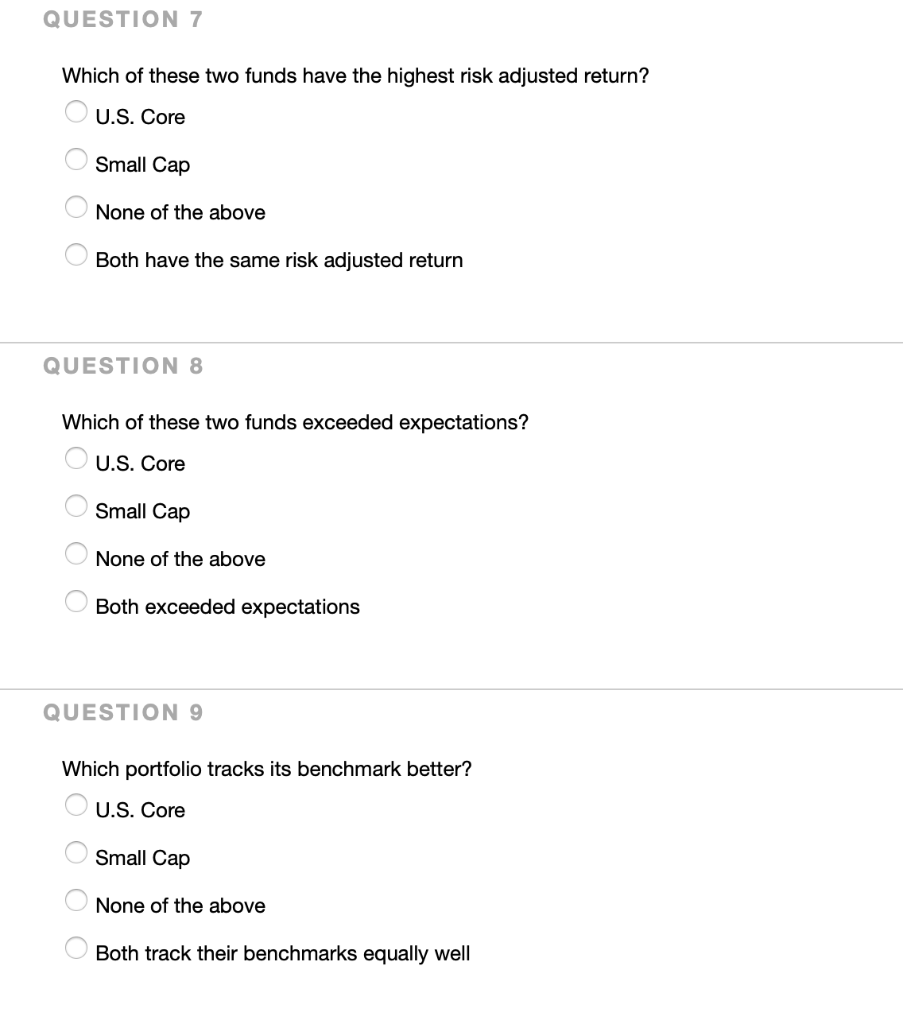

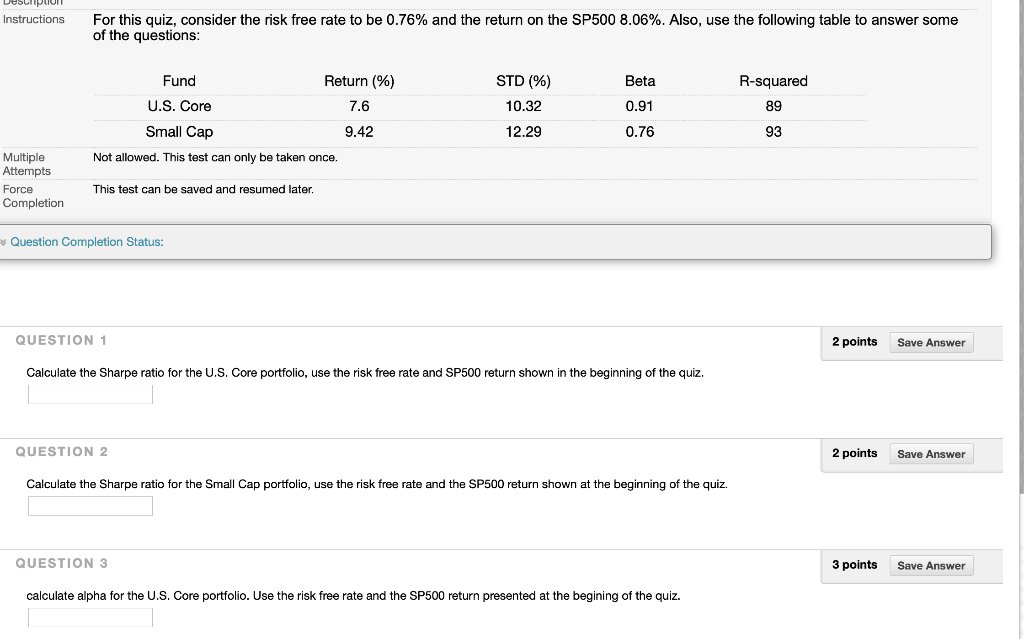

QUESTION 4 Calculate alpha for the Small Cap portfolio. Use the risk free rate and SP500 return shown at the beginning of the quiz. QUESTION 5 Which of the two funds have the highest relative risk? U.S. Core Small Cap None of the above Both have the same relative risk QUESTION 6 Which of the two funds have the highest absolute risk? U.S. Core Small Cap None of the above Both have the same absolute risk QUESTION 7 Which of these two funds have the highest risk adjusted return? U.S. Core Small Cap QUESTION 7 Which of these two funds have the highest risk adjusted return? U.S. Core Small Cap None of the above Both have the same risk adjusted return QUESTION 8 Which of these two funds exceeded expectations? U.S. Core Small Cap None of the above Both exceeded expectations QUESTION 9 Which portfolio tracks its benchmark better? U.S. Core Small Cap None of the above Both track their benchmarks equally well For this quiz, consider the risk free rate to be 0.76% and the return on the SP500 8.06%. Also, use the following table to answer some of the questions: Instructions Fund Return (%) STD (%) Beta R-squared U.S. Core 7.6 10.32 0.91 89 Small Cap 12.29 0.76 9.42 93 Not allowed. This test can only be taken once. Multiple Attempts This test can be saved and resumed late. Force Completion Question Completion Status: QUESTION 1 2 points Save Answer Calculate the Sharpe ratio for the U.S. Core portfolio, use the risk free rate and SP500 return shown in the beginning of the quiz. QUESTION 2 2 points Save Answer Calculate the Sharpe ratio for the Small Cap portfolio, use the risk free rate and the SP500 return shown at the beginning of the quiz. QUESTION 3 3 points Save Answer calculate alpha for the U.S. Core portfolio. Use the risk free rate and the SP500 return presented t the begining of the quiz. QUESTION 4 Calculate alpha for the Small Cap portfolio. Use the risk free rate and SP500 return shown at the beginning of the quiz. QUESTION 5 Which of the two funds have the highest relative risk? U.S. Core Small Cap None of the above Both have the same relative risk QUESTION 6 Which of the two funds have the highest absolute risk? U.S. Core Small Cap None of the above Both have the same absolute risk QUESTION 7 Which of these two funds have the highest risk adjusted return? U.S. Core Small Cap QUESTION 7 Which of these two funds have the highest risk adjusted return? U.S. Core Small Cap None of the above Both have the same risk adjusted return QUESTION 8 Which of these two funds exceeded expectations? U.S. Core Small Cap None of the above Both exceeded expectations QUESTION 9 Which portfolio tracks its benchmark better? U.S. Core Small Cap None of the above Both track their benchmarks equally well For this quiz, consider the risk free rate to be 0.76% and the return on the SP500 8.06%. Also, use the following table to answer some of the questions: Instructions Fund Return (%) STD (%) Beta R-squared U.S. Core 7.6 10.32 0.91 89 Small Cap 12.29 0.76 9.42 93 Not allowed. This test can only be taken once. Multiple Attempts This test can be saved and resumed late. Force Completion Question Completion Status: QUESTION 1 2 points Save Answer Calculate the Sharpe ratio for the U.S. Core portfolio, use the risk free rate and SP500 return shown in the beginning of the quiz. QUESTION 2 2 points Save Answer Calculate the Sharpe ratio for the Small Cap portfolio, use the risk free rate and the SP500 return shown at the beginning of the quiz. QUESTION 3 3 points Save Answer calculate alpha for the U.S. Core portfolio. Use the risk free rate and the SP500 return presented t the begining of the quiz

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts