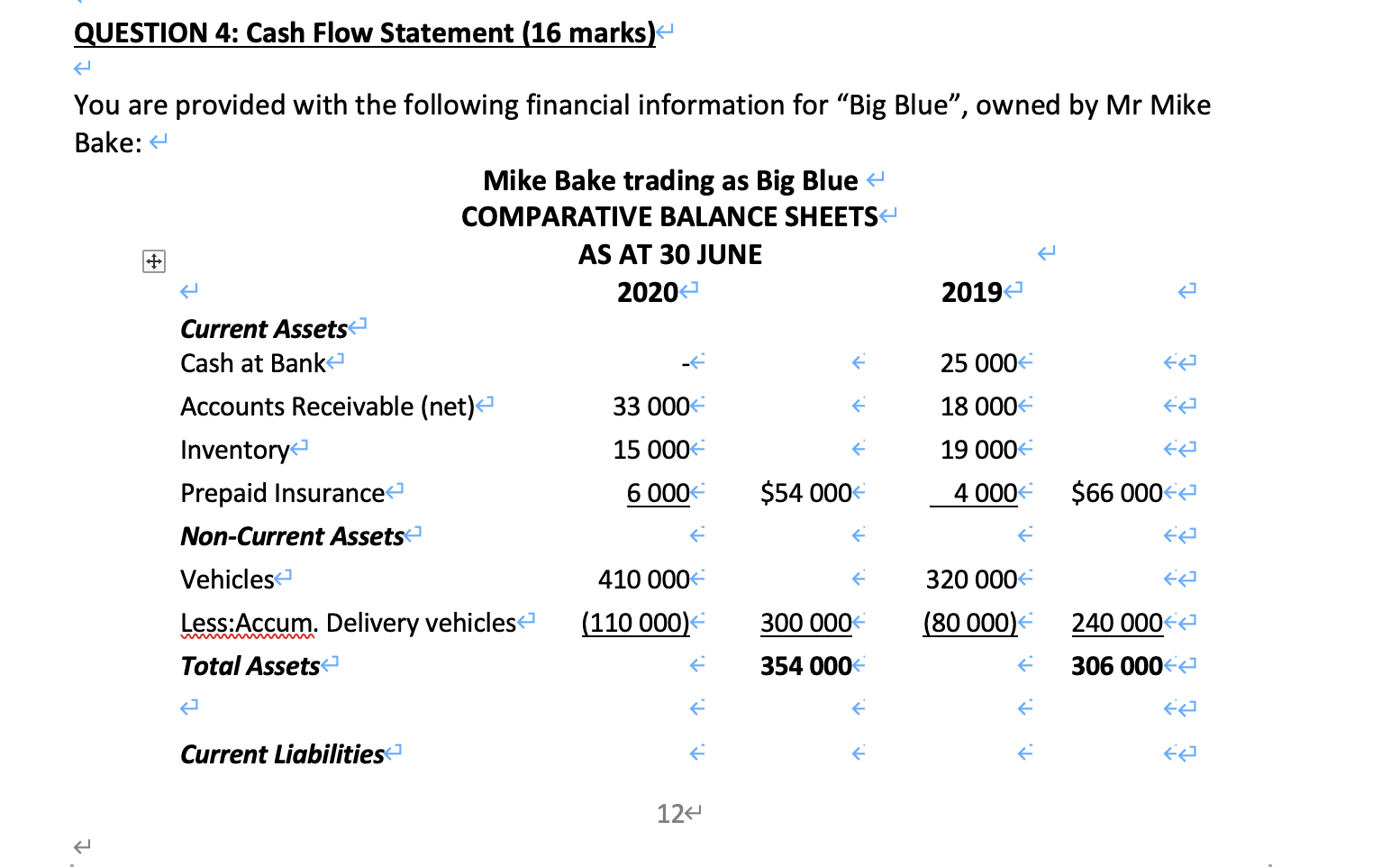

Question: QUESTION 4: Cash Flow Statement (16 marks) You are provided with the following financial information for Big Blue, owned by Mr Mike Bake: - Mike

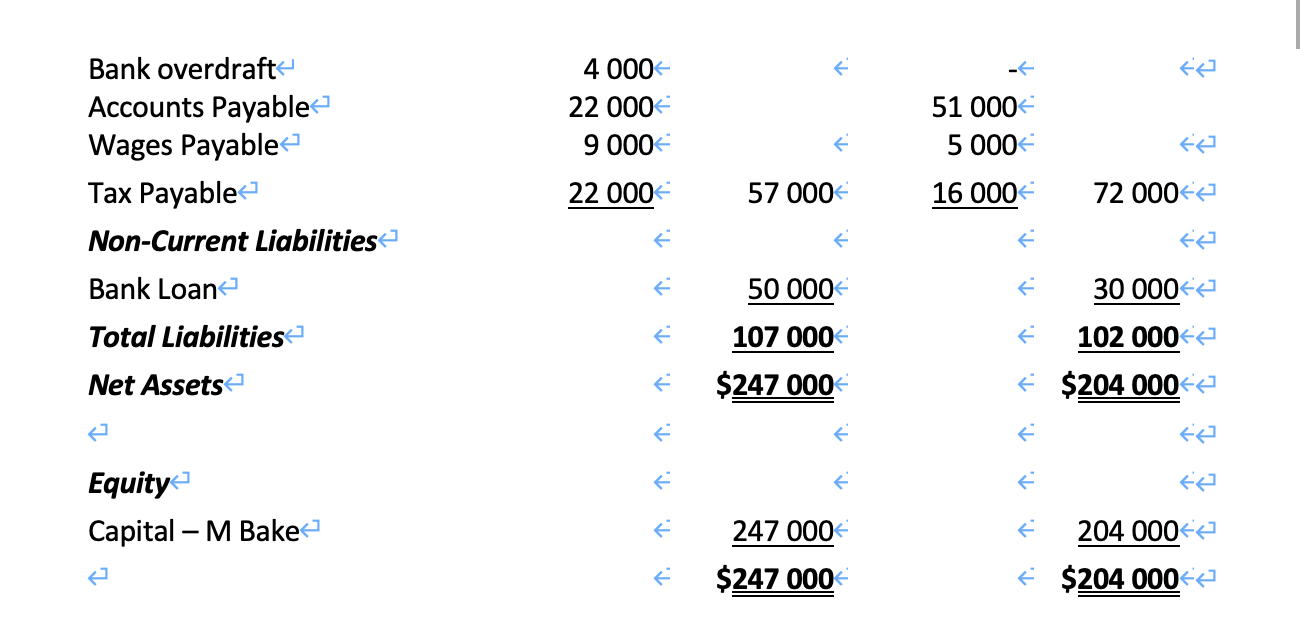

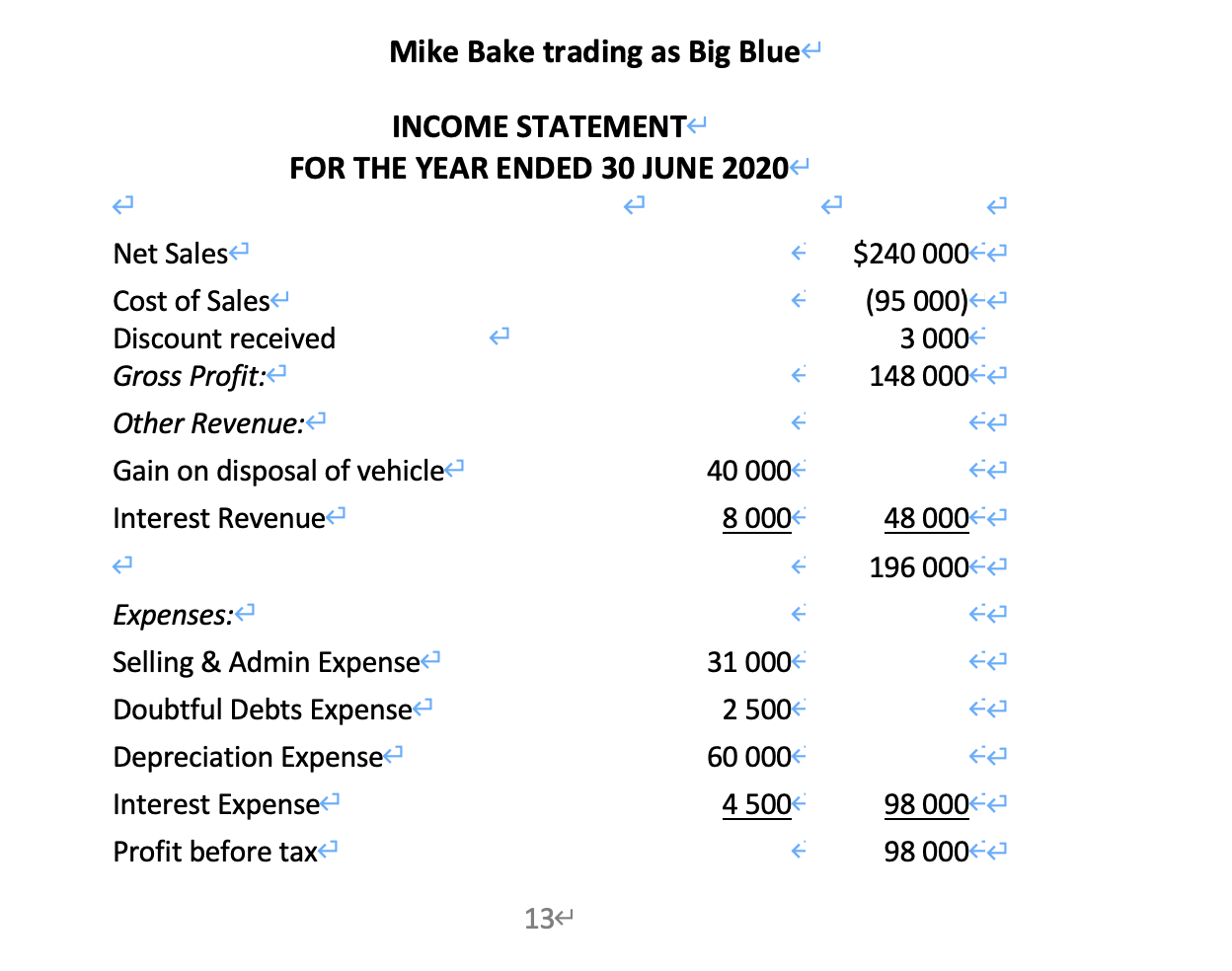

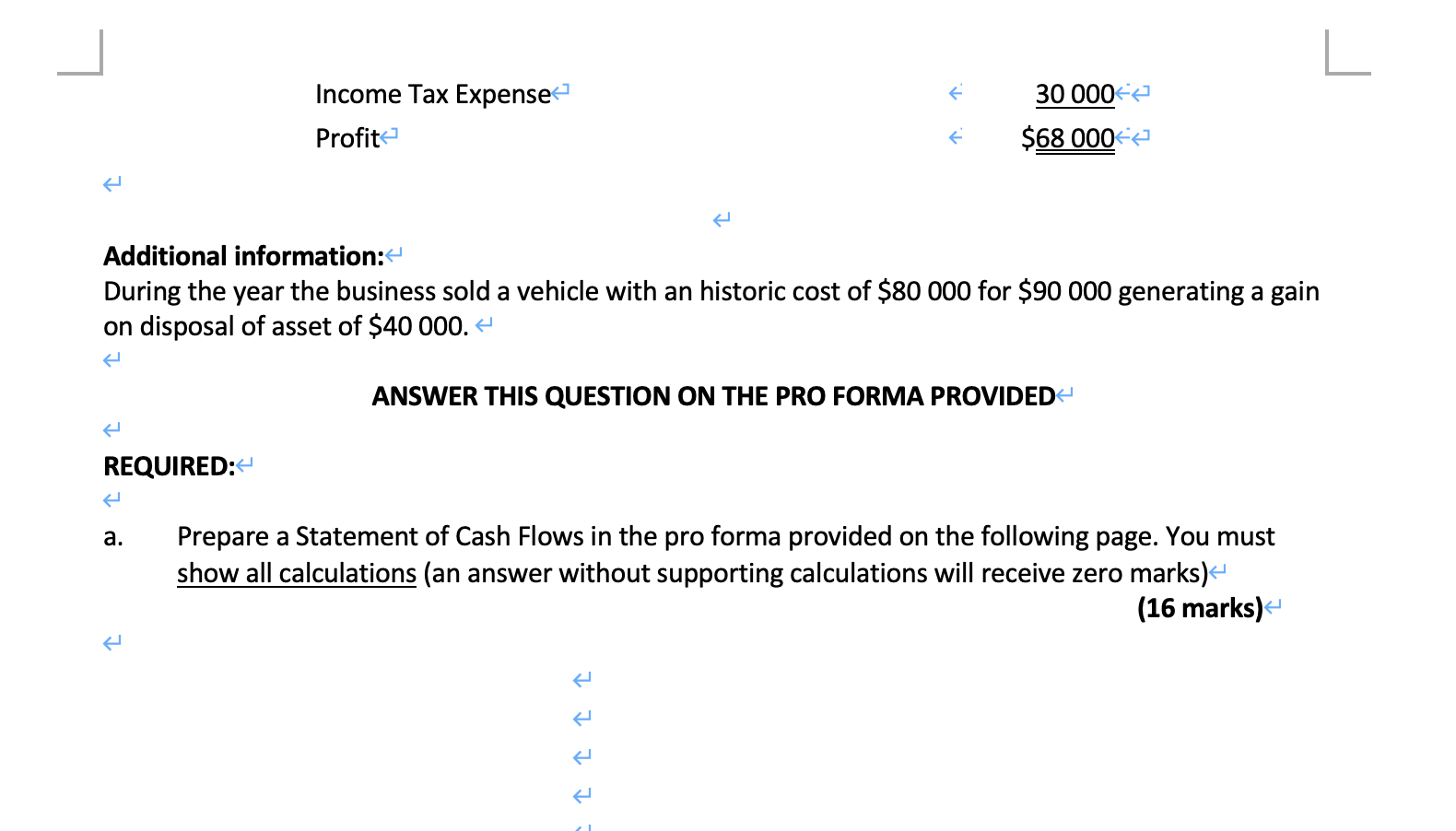

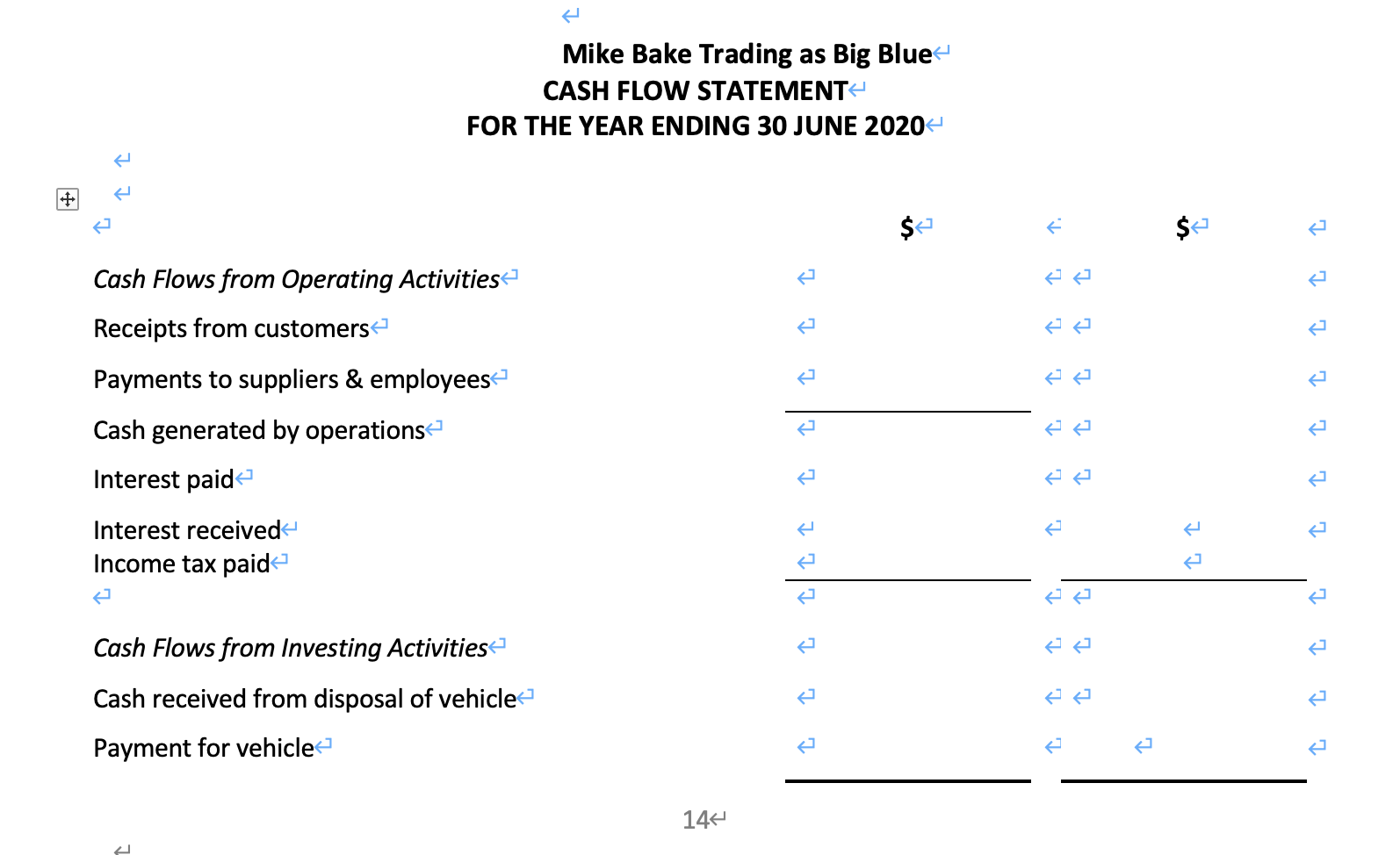

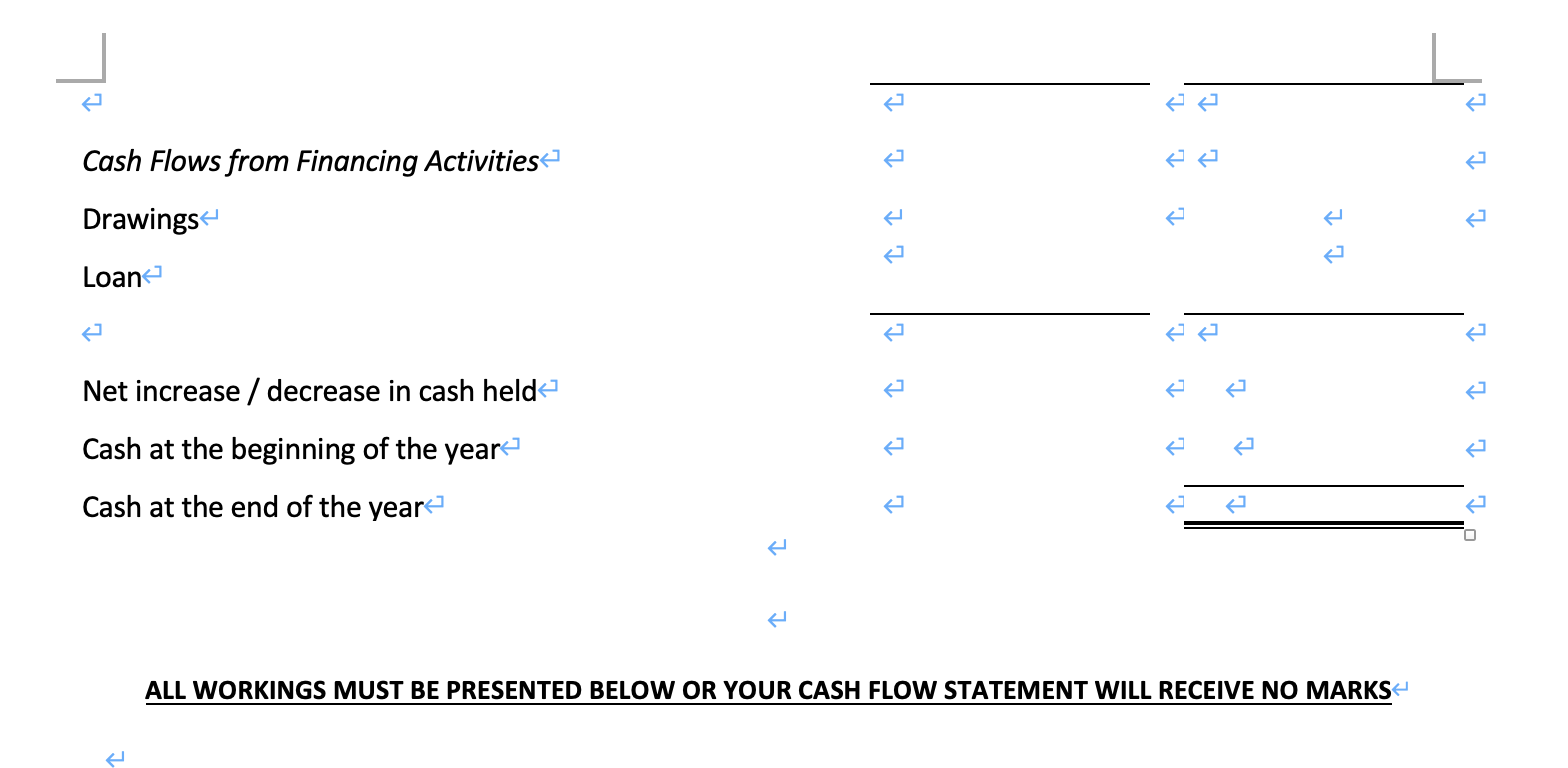

QUESTION 4: Cash Flow Statement (16 marks) You are provided with the following financial information for Big Blue, owned by Mr Mike Bake: - Mike Bake trading as Big Blue COMPARATIVE BALANCE SHEETS + AS AT 30 JUNE 2020 2019 Current Assets Cash at Bank f 25 000 te Accounts Receivable (net) 33 000 f 18 000 te Inventory 15 000 19 000 fe Prepaid Insurance 6 000 $54 000 4 000 $66 00044 Non-Current Assets Vehicles 410 000 320 000 fe Less:Accum. Delivery vehicles (110 000) 300 000 (80 000) 240 000 Total Assets 354 000 306 000 { { { f f fe Current Liabilities fe 124 4 1 4 000 22 000 9 000 51 000 5 000 fe 22 000 57 000 16 000 72 000 Bank overdraft Accounts Payable Wages Payable Tax Payable Non-Current Liabilities Bank Loan Total Liabilities Net Assets E 1 1. fa 50 000 30 000-4 107 000 $247 000 102 000 = $204 000 f { fe k { C fe Equity Capital - M Bake 204 000-4 247 000 $247 000 $204 00047 Mike Bake trading as Big Blue INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE 2020 Net Sales Cost of Sales Discount received Gross Profit: Other Revenue: Gain on disposal of vehicle Interest Revenue $240 0004 (95 000) 3 000 148 000 { f fe 40 000 8 000 48 000 1. 196 0004 fe 31 000 te 2 500 fe Expenses: Selling & Admin Expense Doubtful Debts Expense- Depreciation Expense Interest Expense Profit before tax 60 000 fe 4 500 98 000 98 0004 134 Income Tax Expense Profit 30 000-4 $68 0004 { Additional information: During the year the business sold a vehicle with an historic cost of $80 000 for $90 000 generating a gain on disposal of asset of $40 000.- ANSWER THIS QUESTION ON THE PRO FORMA PROVIDED REQUIRED: a. Prepare a Statement of Cash Flows in the pro forma provided on the following page. You must show all calculations (an answer without supporting calculations will receive zero marks) (16 marks) ^ ^ ^ ^ Mike Bake Trading as Big Blue CASH FLOW STATEMENT FOR THE YEAR ENDING 30 JUNE 2020 + $ 1. $ Cash Flows from Operating Activities Receipts from customers Payments to suppliers & employees Cash generated by operations Interest paid e 1 Interest received Income tax paid Cash Flows from Investing Activities Cash received from disposal of vehicle Payment for vehicle 144 e Cash Flows from Financing Activities Drawings Loan Net increase / decrease in cash held Cash at the beginning of the year Cash at the end of the year O ALL WORKINGS MUST BE PRESENTED BELOW OR YOUR CASH FLOW STATEMENT WILL RECEIVE NO MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts