Question: QUESTION 4 Cedar Processing purchased a machine six years ago at a cost of $650,000. The machine is being depreciated using the straight-line method over

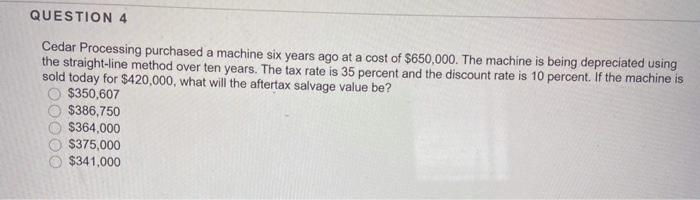

QUESTION 4 Cedar Processing purchased a machine six years ago at a cost of $650,000. The machine is being depreciated using the straight-line method over ten years. The tax rate is 35 percent and the discount rate is 10 percent. If the machine is sold today for $420,000, what will the aftertax salvage value be? $350,607 $386,750 $364,000 $375,000 $341,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts