Question: Question 4 (Chapters 11 and 13) Stock A has a beta of 0.79 and an expected return of 10.29 percent. Stock Bhas a 1.23 beta

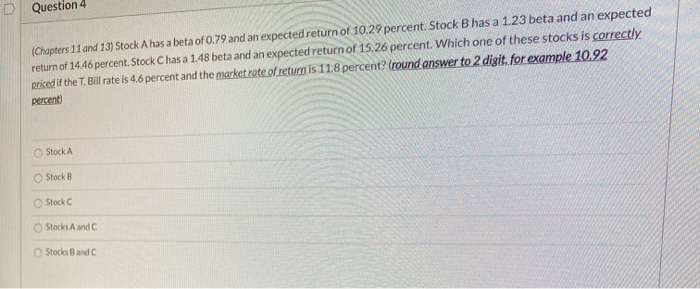

Question 4 (Chapters 11 and 13) Stock A has a beta of 0.79 and an expected return of 10.29 percent. Stock Bhas a 1.23 beta and an expected return of 14.46 percent. Stock C has a 1.48 beta and an expected return of 15.26 percent. Which one of these stocks is correctly priced if the T. Bill rate is 4.6 percent and the market rate of return is 11.8 percent (round answer to 2 digit. for example 10.92 percent) Stock A Stock B Stock Stocks and C Stocks Band

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock