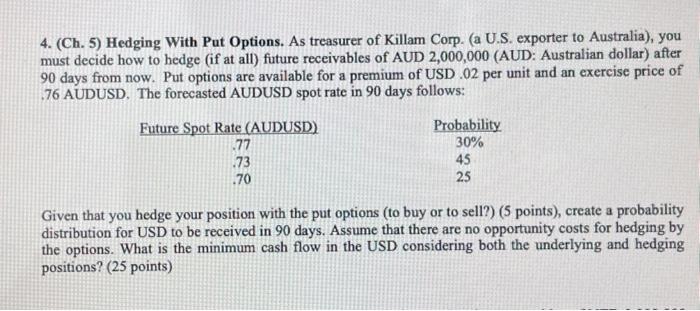

Question: Question 4 (chp5) 4. (Ch. 5) Hedging With Put Options. As treasurer of Killam Corp. (a U.S. exporter to Australia), you must decide how to

4. (Ch. 5) Hedging With Put Options. As treasurer of Killam Corp. (a U.S. exporter to Australia), you must decide how to hedge (if at all) future receivables of AUD 2,000,000 (AUD: Australian dollar) after 90 days from now. Put options are available for a premium of USD .02 per unit and an exercise price of 76 AUDUSD, The forecasted AUDUSD spot rate in 90 days follows: Given that you hedge your position with the put options (to buy or to sell?) ( 5 points), create a probability distribution for USD to be received in 90 days. Assume that there are no opportunity costs for hedging by the options. What is the minimum cash flow in the USD considering both the underlying and hedging positions? ( 25 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts