Question: Question #4 COGS and Inventory Valuation using Alternative Methods (10 points) Brady Co, uses the periodic inventory system, and the following information about company's football

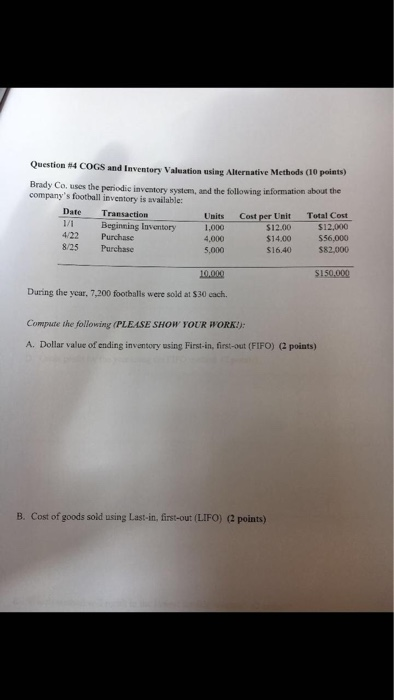

Question #4 COGS and Inventory Valuation using Alternative Methods (10 points) Brady Co, uses the periodic inventory system, and the following information about company's football inventory is available: Date Transaction Units Cost per Unit $12.00 $14.00 $16.40 Total Cost $12,000 556,000 $82,000 1/ Beginning Inventory 1,000 4/22 Purchase 8/25 Purchase 4,000 5,000 $150,000 10.000 During the year, 7,200 footballs were sold at $30 cach. Compute the following (PLEASE SHOW YOUR WORK!): A. Dollar value of ending inventory using First-in, first-out (FIFO) (2 points) B. Cost of goods sold using Last-in, first-out (LIFO) (2 points) C. Weighted average cost per unit (2 points) D. Gross profit for the year using the FIFO method. (2 points) E. Which method will result in the lowest taxable income? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts