Question: Question 4: Commodity Forward Contracts with Convenience Yield (3/10) (This question is designed to help you understand why forward prices can be different across different

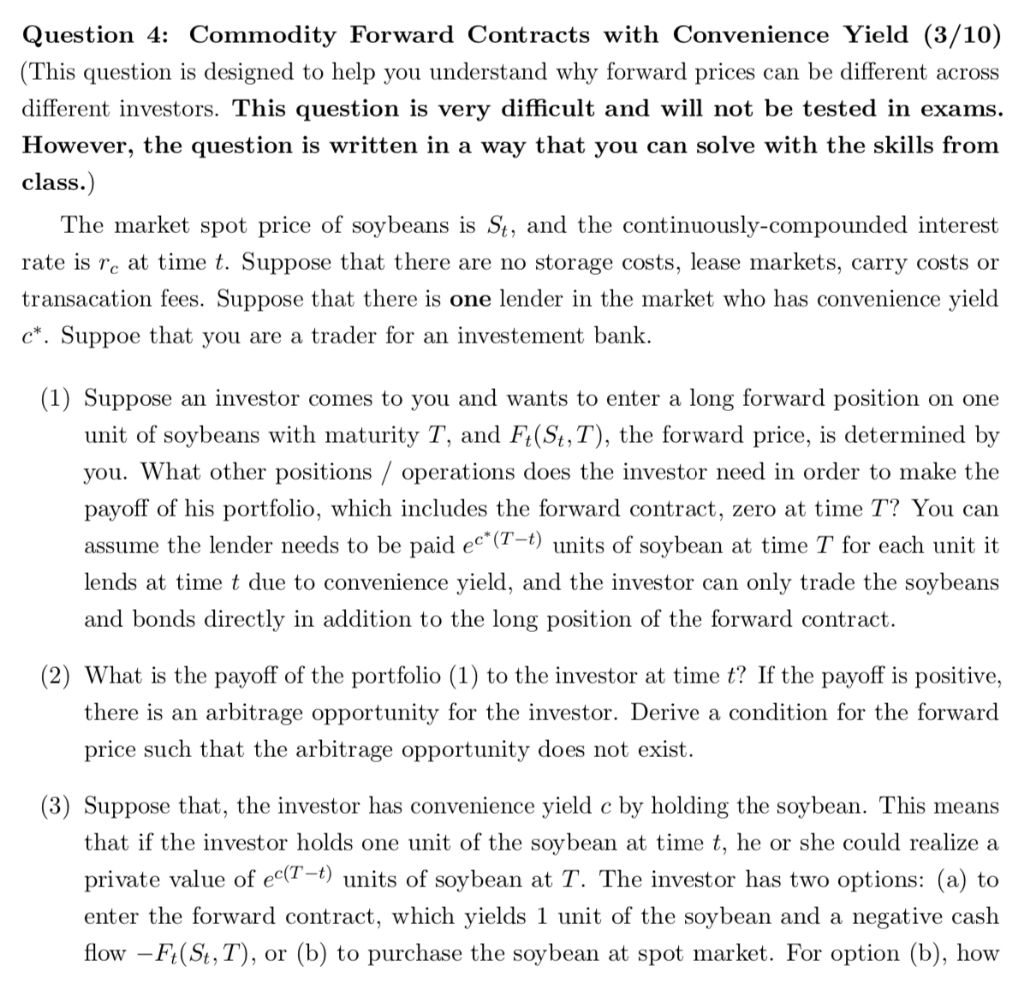

Question 4: Commodity Forward Contracts with Convenience Yield (3/10) (This question is designed to help you understand why forward prices can be different across different investors. This question is very difficult and will not be tested in exams. However, the question is written in a way that you can solve with the skills from class.) The market spot price of soybeans is St, and the continuously-compounded interest rate is rc at time t. Suppose that there are no storage costs, lease markets, carry costs or transacation fees. Suppose that there is one lender in the market who has convenience yield c*. Suppoe that you are a trader for an investement bank. (1) Suppose an investor comes to you and wants to enter a long forward position on one unit of soybeans with maturity T, and Ft(St,T), the forward price, is determined by you. What other positions / operations does the investor need in order to make the payoff of his portfolio, which includes the forward contract, zero at time T? You can assume the lender needs to be paid ec* (T-t) units of soybean at time T for each unit it lends at time t due to convenience yield, and the investor can only trade the soybeans and bonds directly in addition to the long position of the forward contract. (2) What is the payoff of the portfolio (1) to the investor at time t? If the payoff is positive, there is an arbitrage opportunity for the investor. Derive a condition for the forward price such that the arbitrage opportunity does not exist. (3) Suppose that, the investor has convenience yield c by holding the soybean. This means that if the investor holds one unit of the soybean at time t, he or she could realize a private value of ec(T-t) units of soybean at T. The investor has two options: (a) to enter the forward contract, which yields 1 unit of the soybean and a negative cash flow Ft(St, T), or (b) to purchase the soybean at spot market. For option (b), how many units of soybeans does the investor need to purchase in order to replicate the value of the floating part in the forward contract? Suppose the investor could fund the purchase at market risk-free rate, how much does the investor need to return at time T if he or she did decide to make the purchase at the spot market? Provide another condition such that the investor prefers to enter the forward contract than to purchase the soybeans in the spot market. (4) Combination of the conditions from (2) and (3) implies that the investor is willing to long the forward contract without finding an arbitrage opportunity. Derive a final condition such that there could be forward prices that meet both conditions from (2) and (3). The investor is willing to long the forward contract at any forward prices that meet both conditions. This implies that there could be a range of forward prices in the economy if there is only one lender, and the investment bank could potentially extract some porfits. (Hint: the condition only involves c and c*). Question 4: Commodity Forward Contracts with Convenience Yield (3/10) (This question is designed to help you understand why forward prices can be different across different investors. This question is very difficult and will not be tested in exams. However, the question is written in a way that you can solve with the skills from class.) The market spot price of soybeans is St, and the continuously-compounded interest rate is rc at time t. Suppose that there are no storage costs, lease markets, carry costs or transacation fees. Suppose that there is one lender in the market who has convenience yield c*. Suppoe that you are a trader for an investement bank. (1) Suppose an investor comes to you and wants to enter a long forward position on one unit of soybeans with maturity T, and Ft(St,T), the forward price, is determined by you. What other positions / operations does the investor need in order to make the payoff of his portfolio, which includes the forward contract, zero at time T? You can assume the lender needs to be paid ec* (T-t) units of soybean at time T for each unit it lends at time t due to convenience yield, and the investor can only trade the soybeans and bonds directly in addition to the long position of the forward contract. (2) What is the payoff of the portfolio (1) to the investor at time t? If the payoff is positive, there is an arbitrage opportunity for the investor. Derive a condition for the forward price such that the arbitrage opportunity does not exist. (3) Suppose that, the investor has convenience yield c by holding the soybean. This means that if the investor holds one unit of the soybean at time t, he or she could realize a private value of ec(T-t) units of soybean at T. The investor has two options: (a) to enter the forward contract, which yields 1 unit of the soybean and a negative cash flow Ft(St, T), or (b) to purchase the soybean at spot market. For option (b), how many units of soybeans does the investor need to purchase in order to replicate the value of the floating part in the forward contract? Suppose the investor could fund the purchase at market risk-free rate, how much does the investor need to return at time T if he or she did decide to make the purchase at the spot market? Provide another condition such that the investor prefers to enter the forward contract than to purchase the soybeans in the spot market. (4) Combination of the conditions from (2) and (3) implies that the investor is willing to long the forward contract without finding an arbitrage opportunity. Derive a final condition such that there could be forward prices that meet both conditions from (2) and (3). The investor is willing to long the forward contract at any forward prices that meet both conditions. This implies that there could be a range of forward prices in the economy if there is only one lender, and the investment bank could potentially extract some porfits. (Hint: the condition only involves c and c*)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts