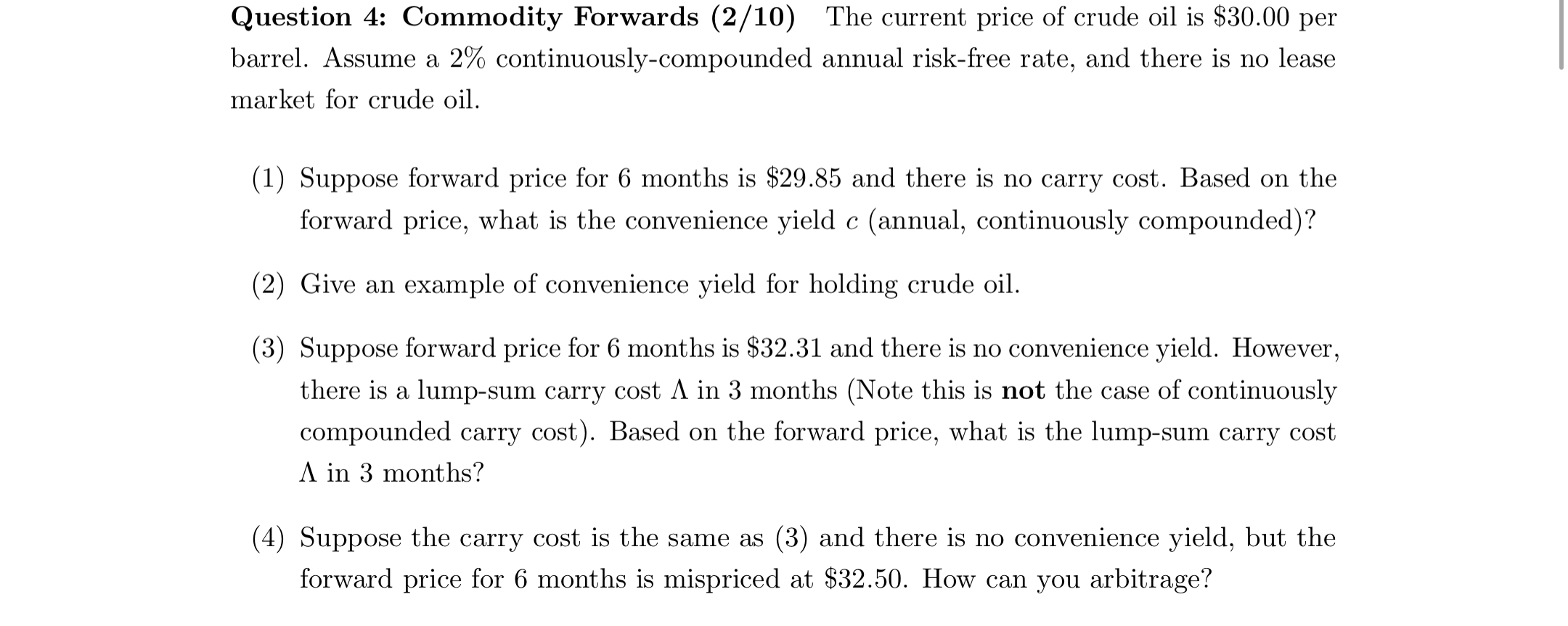

Question: Question 4 : Commodity Forwards ( 2 / 1 0 ) The current price of crude oil is $ 3 0 . 0 0 per

Question : Commodity Forwards The current price of crude oil is $ per barrel. Assume a continuouslycompounded annual riskfree rate, and there is no lease market for crude oil.

Suppose forward price for months is $ and there is no carry cost. Based on the forward price, what is the convenience yield annual continuously compounded

Give an example of convenience yield for holding crude oil.

Suppose forward price for months is $ and there is no convenience yield. However, there is a lumpsum carry cost in months Note this is not the case of continuously compounded carry cost Based on the forward price, what is the lumpsum carry cost in months?

Suppose the carry cost is the same as and there is no convenience yield, but the forward price for months is mispriced at $ How can you arbitrage?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock