Question: Question 4 Consider an inverse oating rate coupon bond with 1 year remaining to maturity. On maturity, bondholders are expected to receive $100 face value.

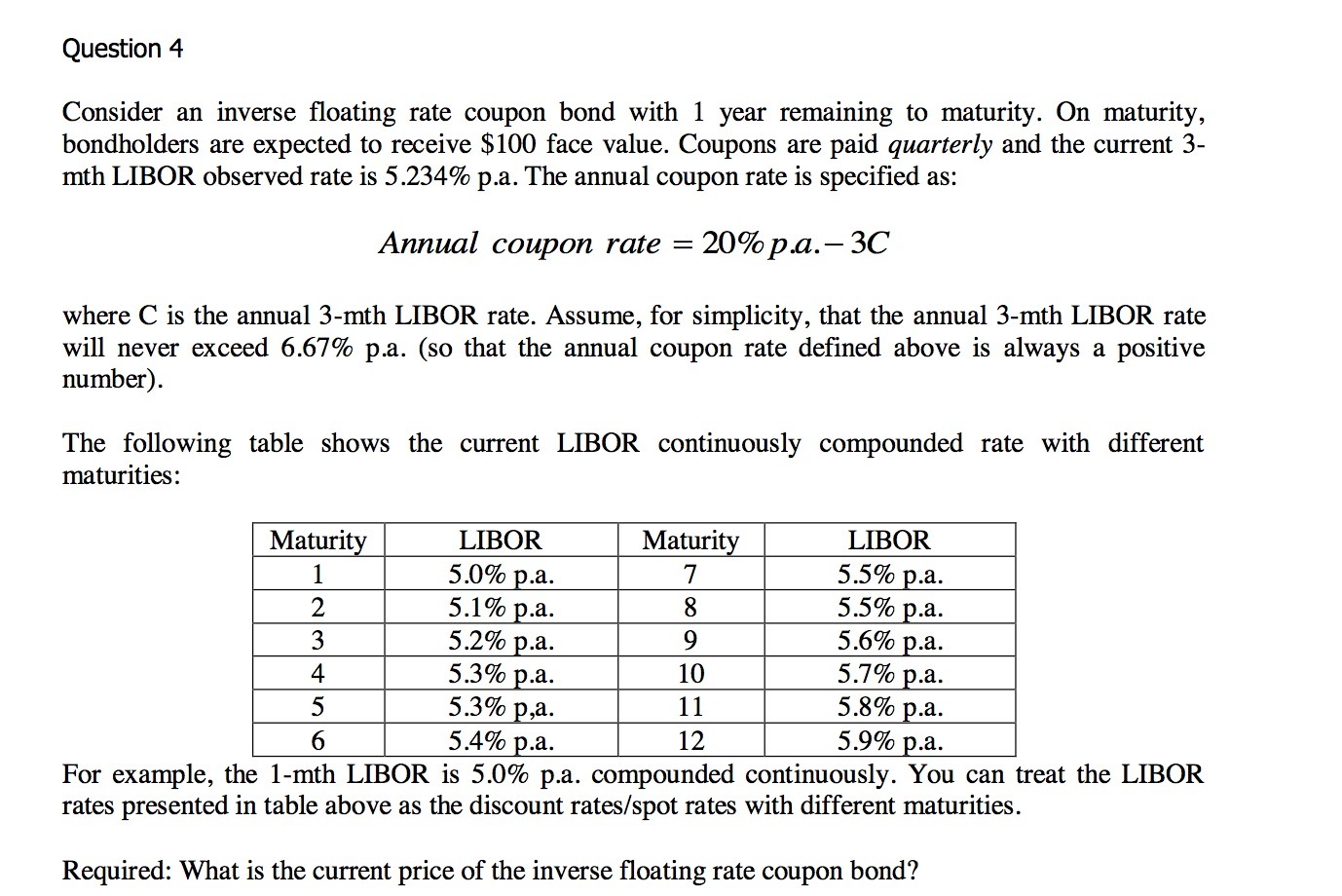

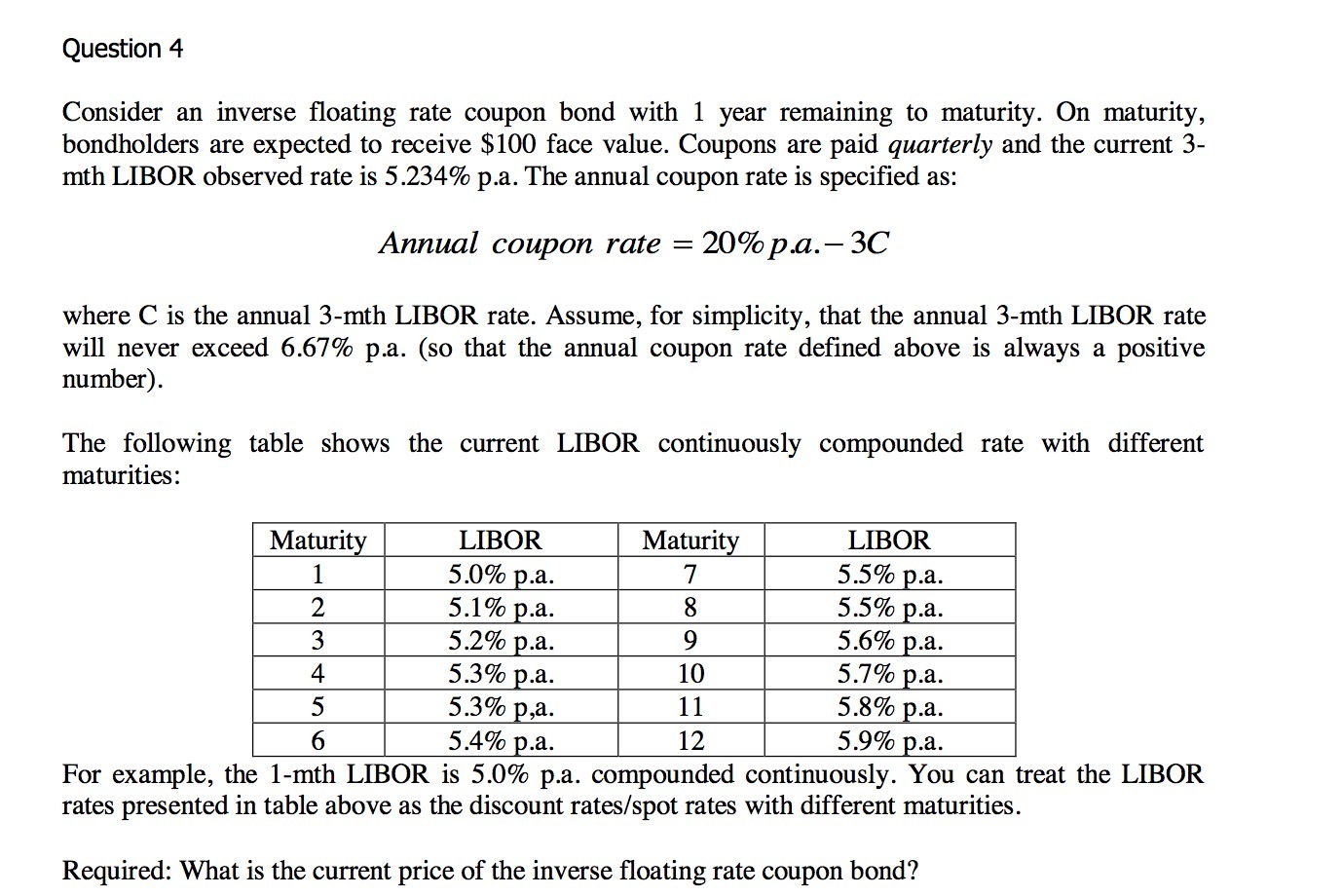

Question 4 Consider an inverse oating rate coupon bond with 1 year remaining to maturity. On maturity, bondholders are expected to receive $100 face value. Coupons are paid quarterly and the current 3 mth LIBOR observed rate is 5.234% p.a. The annual coupon rate is specied as: Annual coupon rate = 20%pa.3C where C is the annual 3mth LIBOR rate. Assume, for simplicity, that the annual 3mth LIBOR rate will never exceed 6.67% pa. (so that the annual coupon rate dened above is always a positive number). The following table shows the current LIBOR continuously compounded rate with different maturities: 6 5.4% p a. 12 5.9% p.a. For example, the 1-mth LIBOR is 5.0% p.a. compounded continuously. You can treat the LIBOR rates presented in table above as the discount rates/spot rates with different maturities. Required: What is the current price of the inverse oating rate coupon bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts