Question: Question 4 Consider the following model when answering questions 4/a. through 4/e.: VL=VU+DTC=EL+D Gem Industries has five million shares outstanding with a market price of

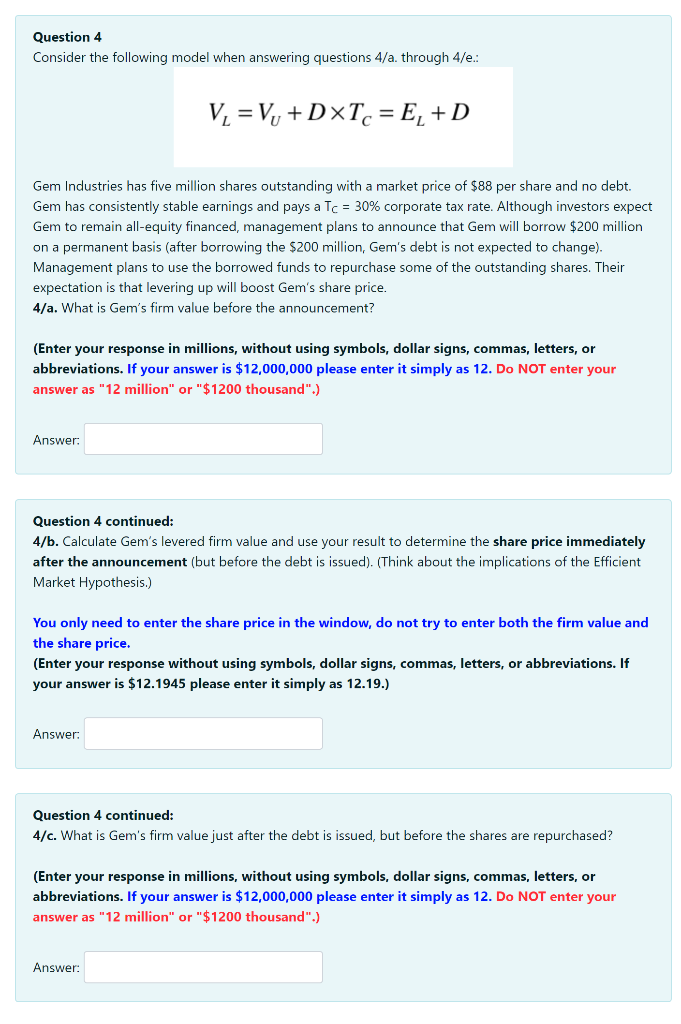

Question 4 Consider the following model when answering questions 4/a. through 4/e.: VL=VU+DTC=EL+D Gem Industries has five million shares outstanding with a market price of $88 per share and no debt. Gem has consistently stable earnings and pays a TC=30% corporate tax rate. Although investors expect Gem to remain all-equity financed, management plans to announce that Gem will borrow $200 million on a permanent basis (after borrowing the $200 million, Gem's debt is not expected to change). Management plans to use the borrowed funds to repurchase some of the outstanding shares. Their expectation is that levering up will boost Gem's share price. 4/a. What is Gem's firm value before the announcement? (Enter your response in millions, without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12,000,000 please enter it simply as 12 . Do NOT enter your answer as "12 million" or "\$1200 thousand".) Answer: Question 4 continued: 4/b. Calculate Gem's levered firm value and use your result to determine the share price immediately after the announcement (but before the debt is issued). (Think about the implications of the Efficient Market Hypothesis.) You only need to enter the share price in the window, do not try to enter both the firm value and the share price. (Enter your response without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12.1945 please enter it simply as 12 .19.) Answer: Question 4 continued: 4/c. What is Gem's firm value just after the debt is issued, but before the shares are repurchased? (Enter your response in millions, without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12,000,000 please enter it simply as 12 . Do NOT enter your answer as "12 million" or "\$1200 thousand".) Answer: Question 4 continued: 4/d. How many shares will Gem repurchase? (Enter your response in millions, without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12,750,000 enter it simply as 12.75 please. Do NOT enter your answer as "12.75 million" or "\$1275 thousand".) Answer: Question 4 continued: 4/e. What is the market value of Gem's equity (the value of all Gem shares combined) after the share repurchase is completed? (Enter your response in millions, without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12,000,000 please enter it simply as 12 . Do NOT enter your answer as "12 million" or "\$1200 thousand".) Answer: Question 4 Consider the following model when answering questions 4/a. through 4/e.: VL=VU+DTC=EL+D Gem Industries has five million shares outstanding with a market price of $88 per share and no debt. Gem has consistently stable earnings and pays a TC=30% corporate tax rate. Although investors expect Gem to remain all-equity financed, management plans to announce that Gem will borrow $200 million on a permanent basis (after borrowing the $200 million, Gem's debt is not expected to change). Management plans to use the borrowed funds to repurchase some of the outstanding shares. Their expectation is that levering up will boost Gem's share price. 4/a. What is Gem's firm value before the announcement? (Enter your response in millions, without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12,000,000 please enter it simply as 12 . Do NOT enter your answer as "12 million" or "\$1200 thousand".) Answer: Question 4 continued: 4/b. Calculate Gem's levered firm value and use your result to determine the share price immediately after the announcement (but before the debt is issued). (Think about the implications of the Efficient Market Hypothesis.) You only need to enter the share price in the window, do not try to enter both the firm value and the share price. (Enter your response without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12.1945 please enter it simply as 12 .19.) Answer: Question 4 continued: 4/c. What is Gem's firm value just after the debt is issued, but before the shares are repurchased? (Enter your response in millions, without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12,000,000 please enter it simply as 12 . Do NOT enter your answer as "12 million" or "\$1200 thousand".) Answer: Question 4 continued: 4/d. How many shares will Gem repurchase? (Enter your response in millions, without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12,750,000 enter it simply as 12.75 please. Do NOT enter your answer as "12.75 million" or "\$1275 thousand".) Answer: Question 4 continued: 4/e. What is the market value of Gem's equity (the value of all Gem shares combined) after the share repurchase is completed? (Enter your response in millions, without using symbols, dollar signs, commas, letters, or abbreviations. If your answer is $12,000,000 please enter it simply as 12 . Do NOT enter your answer as "12 million" or "\$1200 thousand".)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts