Question: Question 4 Consider the following numerical example for adverse selection. There are two projects A and B , and the investment of these projects are

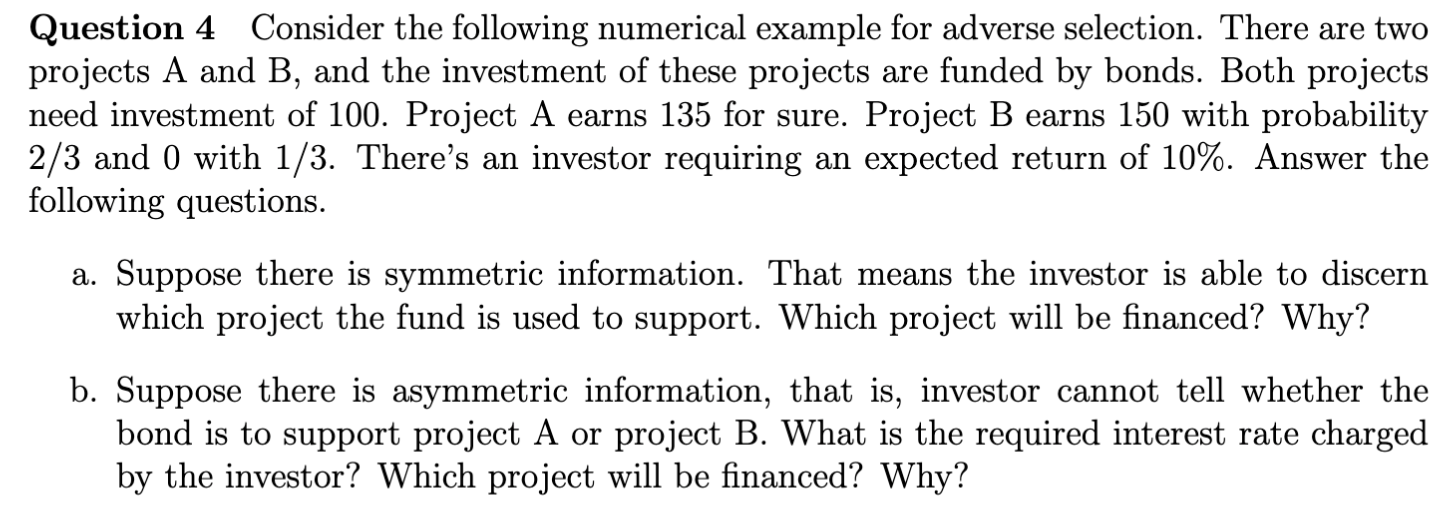

Question Consider the following numerical example for adverse selection. There are two

projects A and B and the investment of these projects are funded by bonds. Both projects

need investment of Project A earns for sure. Project B earns with probability

and with There's an investor requiring an expected return of Answer the

following questions.

a Suppose there is symmetric information. That means the investor is able to discern

which project the fund is used to support. Which project will be financed? Why?

b Suppose there is asymmetric information, that is investor cannot tell whether the

bond is to support project or project What is the required interest rate charged

by the investor? Which project will be financed? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock