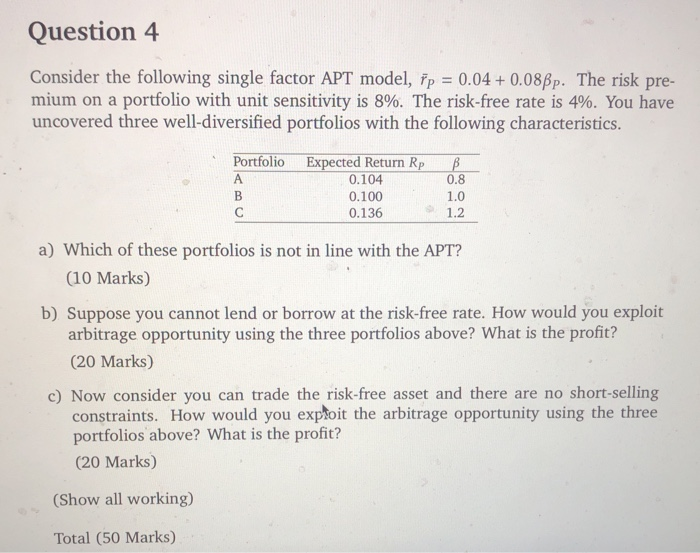

Question: Question 4 Consider the following single factor APT model, p = 0.04 + 0.08p. The risk pre- mium on a portfolio with unit sensitivity is

Question 4 Consider the following single factor APT model, p = 0.04 + 0.08p. The risk pre- mium on a portfolio with unit sensitivity is 8%. The risk-free rate is 4%. You have uncovered three well-diversified portfolios with the following characteristics. Portfolio B 0.8 Expected Return Rp 0.104 0.100 0.136 a) Which of these portfolios is not in line with the APT? (10 Marks) b) Suppose you cannot lend or borrow at the risk-free rate. How would you exploit arbitrage opportunity using the three portfolios above? What is the profit? (20 Marks) c) Now consider you can trade the risk-free asset and there are no short-selling constraints. How would you exploit the arbitrage opportunity using the three portfolios above? What is the profit? (20 Marks) (Show all working) Total (50 Marks) Question 4 Consider the following single factor APT model, p = 0.04 + 0.08p. The risk pre- mium on a portfolio with unit sensitivity is 8%. The risk-free rate is 4%. You have uncovered three well-diversified portfolios with the following characteristics. Portfolio B 0.8 Expected Return Rp 0.104 0.100 0.136 a) Which of these portfolios is not in line with the APT? (10 Marks) b) Suppose you cannot lend or borrow at the risk-free rate. How would you exploit arbitrage opportunity using the three portfolios above? What is the profit? (20 Marks) c) Now consider you can trade the risk-free asset and there are no short-selling constraints. How would you exploit the arbitrage opportunity using the three portfolios above? What is the profit? (20 Marks) (Show all working) Total (50 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts