Question: QUESTION 4 (cont'd) Part 2 If you at the same time receive the recommendation of another project (Project B) from your CFO, which has the

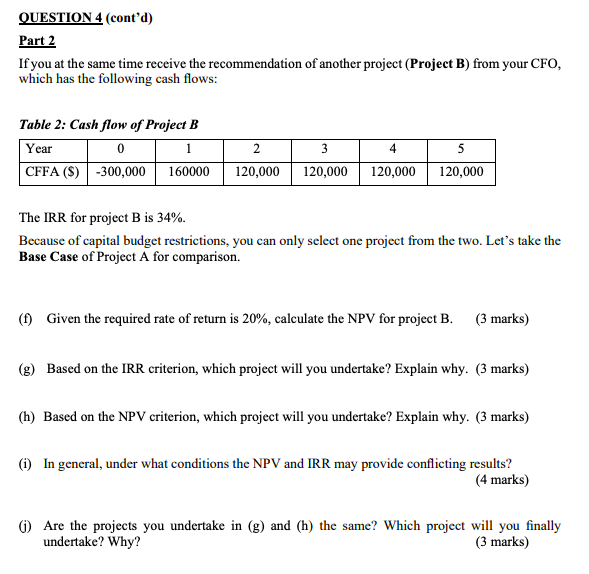

QUESTION 4 (cont'd) Part 2 If you at the same time receive the recommendation of another project (Project B) from your CFO, which has the following cash flows: Table 2: Cash flow of Project B Year 0 1 CFFA (S)-300,000 160000 2 120,000 3 120,000 4 120,000 5 120,000 The IRR for project B is 34%. Because of capital budget restrictions, you can only select one project from the two. Let's take the Base Case of Project A for comparison. (1) Given the required rate of return is 20%, calculate the NPV for project B. (3 marks) (9) Based on the IRR criterion, which project will you undertake? Explain why. (3 marks) (h) Based on the NPV criterion, which project will you undertake? Explain why. (3 marks) (1) In general, under what conditions the NPV and IRR may provide conflicting results? (4 marks) 6) Are the projects you undertake in (g) and (h) the same? Which project will you finally undertake? Why? (3 marks) QUESTION 4 (cont'd) Part 2 If you at the same time receive the recommendation of another project (Project B) from your CFO, which has the following cash flows: Table 2: Cash flow of Project B Year 0 1 CFFA (S)-300,000 160000 2 120,000 3 120,000 4 120,000 5 120,000 The IRR for project B is 34%. Because of capital budget restrictions, you can only select one project from the two. Let's take the Base Case of Project A for comparison. (1) Given the required rate of return is 20%, calculate the NPV for project B. (3 marks) (9) Based on the IRR criterion, which project will you undertake? Explain why. (3 marks) (h) Based on the NPV criterion, which project will you undertake? Explain why. (3 marks) (1) In general, under what conditions the NPV and IRR may provide conflicting results? (4 marks) 6) Are the projects you undertake in (g) and (h) the same? Which project will you finally undertake? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts