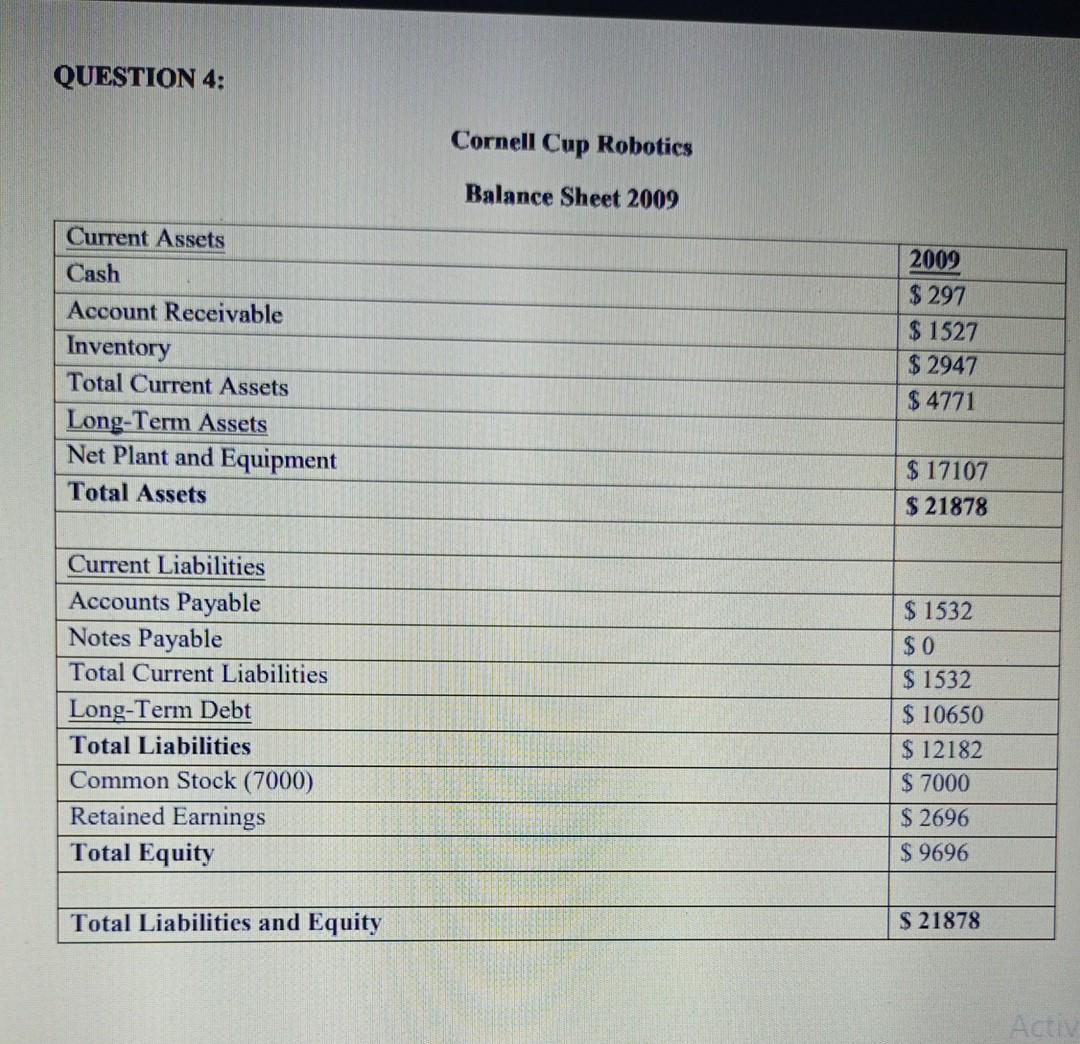

Question: QUESTION 4: Cornell Cup Robotics Balance Sheet 2009 2009 Current Assets Cash Account Receivable Inventory Total Current Assets Long-Term Assets Net Plant and Equipment Total

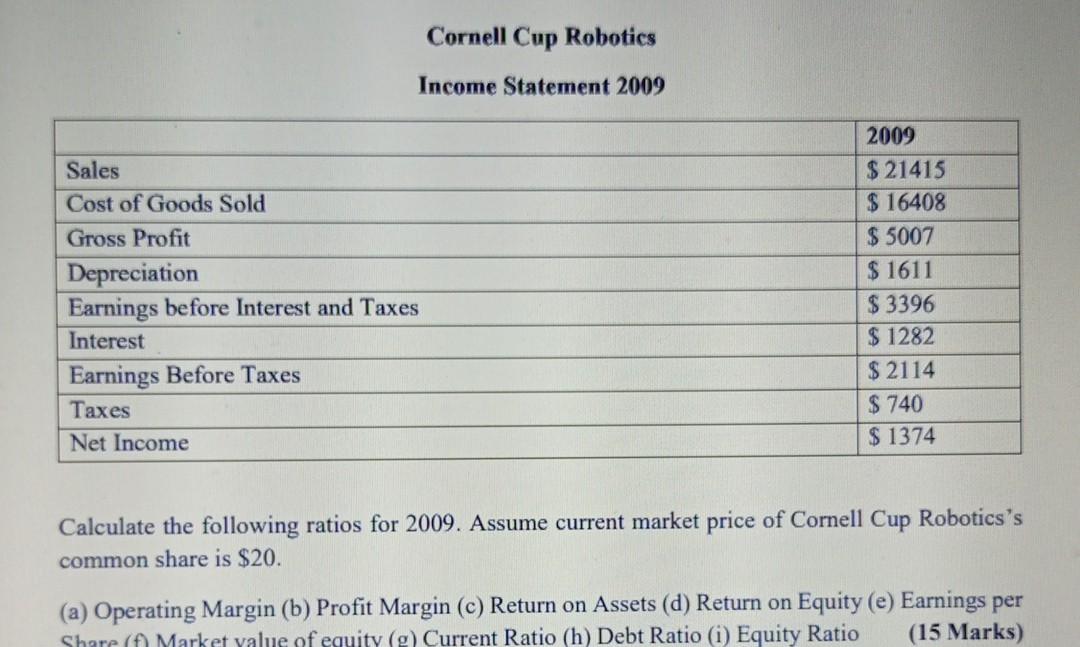

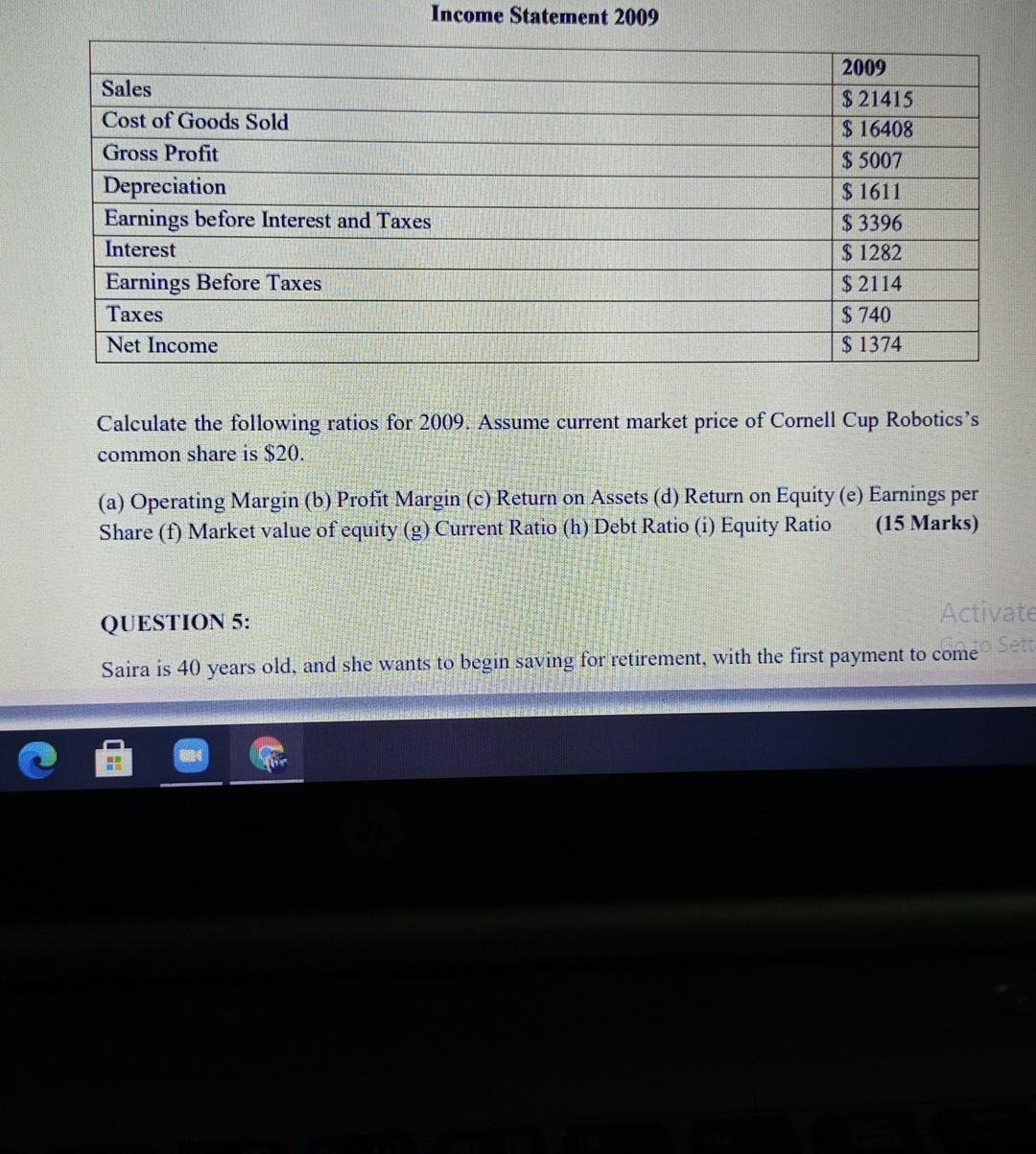

QUESTION 4: Cornell Cup Robotics Balance Sheet 2009 2009 Current Assets Cash Account Receivable Inventory Total Current Assets Long-Term Assets Net Plant and Equipment Total Assets $ 297 $ 1527 $ 2947 $ 4771 $ 17107 $ 21878 Current Liabilities Accounts Payable Notes Payable Total Current Liabilities Long-Term Debt Total Liabilities Common Stock (7000) Retained Earnings Total Equity $ 1532 $0 $ 1532 $ 10650 $ 12182 $ 7000 $ 2696 $ 9696 Total Liabilities and Equity S 21878 Active Cornell Cup Robotics Income Statement 2009 Sales Cost of Goods Sold Gross Profit Depreciation Earnings before Interest and Taxes Interest Earnings Before Taxes Taxes Net Income 2009 $ 21415 $ 16408 $ 5007 $ 1611 $ 3396 $ 1282 $ 2114 $ 740 $ 1374 Calculate the following ratios for 2009. Assume current market price of Cornell Cup Robotics's common share is $20. (a) Operating Margin (b) Profit Margin (c) Return on Assets (d) Return on Equity (e) Earnings per Share (f Market yalue of equity (g) Current Ratio (h) Debt Ratio (i) Equity Ratio (15 Marks) Income Statement 2009 Sales Cost of Goods Sold Gross Profit Depreciation Earnings before Interest and Taxes Interest Earnings Before Taxes Taxes Net Income 2009 $ 21415 $ 16408 $ 5007 $ 1611 $ 3396 $ 1282 $ 2114 $ 740 $ 1374 Calculate the following ratios for 2009. Assume current market price of Cornell Cup Robotics's common share is $20. (a) Operating Margin (b) Profit Margin (c) Return on Assets (d) Return on Equity (e) Earnings per Share (f) Market value of equity (g) Current Ratio (h) Debt Ratio (i) Equity Ratio (15 Marks) QUESTION 5: Activate do Set Saira is 40 years old, and she wants to begin saving for retirement, with the first payment to come

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts