Question: Question 4: Depreciation Methods (20 points; Suggested time: 25 min) On June 30, 2016, American Postal Service (APS) Inc. bought a delivery van by paying

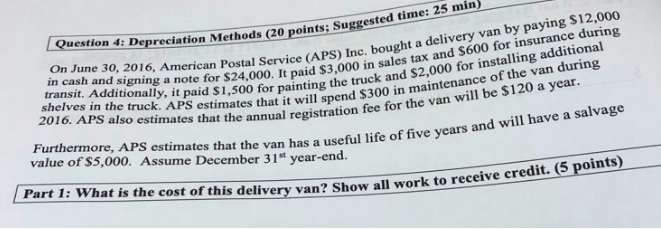

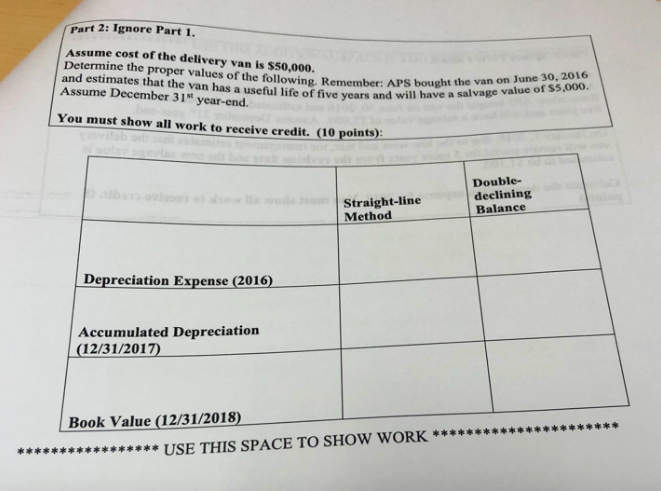

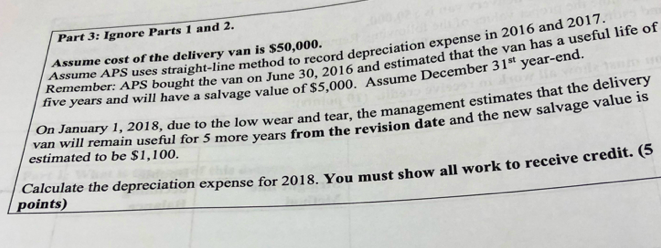

Question 4: Depreciation Methods (20 points; Suggested time: 25 min) On June 30, 2016, American Postal Service (APS) Inc. bought a delivery van by paying $12,000 in cash and signing a note for $24,000. It paid $3,000 in sales tax and $600 for insurance during transit. Additionally, it paid $1,500 for painting the truck and $2,000 for installing additional shelves in the truck. APS estimates that it will spend $300 in maintenance of the van during 2016. APS also estimates that the annual registration fee for the van will be $120 a year. Furthermore, APS estimates that the van has a useful life of five years and will have a salvage value of $5,000. Assume December 31t year-end. Part 1: What is the cost of this delivery van? Show all work to receive credit. (5 points) Part 2: Ignore Part 1. ASsume cost of the delivery van is $50,000. Determine the proper values of the following. Remember: APS bought the van on June 30, 2016 and estimates that the van has a useful life of five years and will have a salvage value of $5,000. Assume December 31 year-end. You must show all work to receive credit. (10 points): Double- declining Balance Straight-line Method Depreciation Expense (2016) Accumulated Depreciation (12/31/2017) Book Value (12/31/2018) **** USE THIS SPACE TO SHOW WORK ** Part 3: Ignore Parts 1 and 2. Assume APS uses straight-line method to record depreciation expense in 2016 and 2017. Remember: APS bought the van on June 30, 2016 and estimated that the van has a useful life of five years and will have a salvage value of $5,000. Assume December 31st year-end. Assume cost of the delivery van is $50,000. On January 1, 2018, due to the low wear and tear, the management estimates that the delivery van will remain useful for 5 more years from the revision date and the new salvage value is estimated to be $1,100 Calculate the depreciation expense for 2018. You must show all work to receive credit. points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts