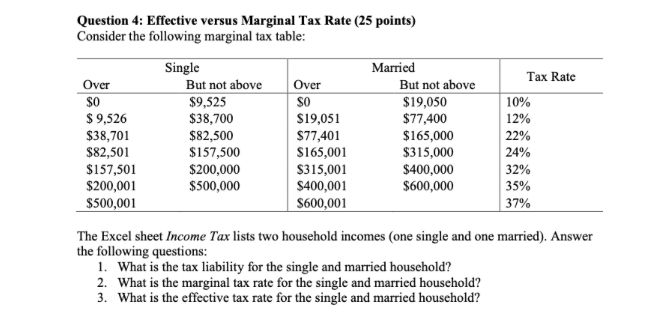

Question: Question 4: Effective versus Marginal Tax Rate (25 points) Consider the following marginal tax table: DI Over $0 $ 9,526 $38,701 $82,501 $157,501 $200,001 $500,001

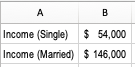

Question 4: Effective versus Marginal Tax Rate (25 points) Consider the following marginal tax table: DI Over $0 $ 9,526 $38,701 $82,501 $157,501 $200,001 $500,001 Single But not above $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 Over SO $19,051 $77,401 $165,001 $315,001 $400,001 $600,001 Married But not above $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 Tax Rate 10% 12% 22% 24% 32% 35% 37% The Excel sheet Income Tax lists two household incomes (one single and one married). Answer the following questions: 1. What is the tax liability for the single and married household? 2. What is the marginal tax rate for the single and married household? 3. What is the effective tax rate for the single and married household? | Income (Single) $ 54,000 Income (Married) $ 146,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts