Question: Question 4 Every point in time mentioned in this problem is at the beginning of each year. It is now 2016. Gravitational Waves (GW) Company

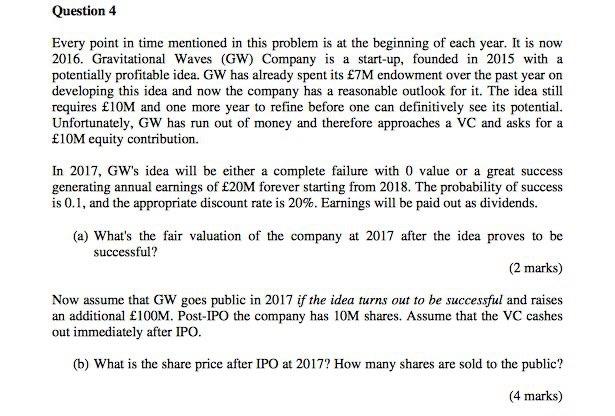

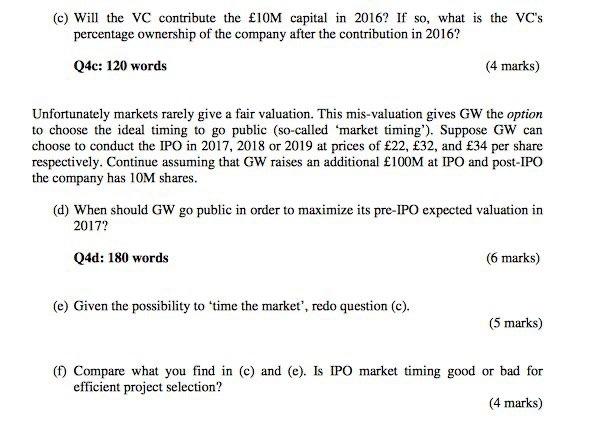

Question 4 Every point in time mentioned in this problem is at the beginning of each year. It is now 2016. Gravitational Waves (GW) Company is a start-up, founded in 2015 with a potentially profitable idea. GW has already spent its 7M endowment over the past year on developing this idea and now the company has a reasonable outlook for it. The idea still requires 10M and one more year to refine before one can definitively see its potential. Unfortunately, GW has run out of money and therefore approaches a VC and asks for a 10M equity contribution. In 2017, GW's idea will be either a complete failure with O value or a great success generating annual earnings of 20M forever starting from 2018. The probability of success is 0.1, and the appropriate discount rate is 20%. Earnings will be paid out as dividends. (a) What's the fair valuation of the company at 2017 after the idea proves to be successful? (2 marks) Now assume that GW goes public in 2017 if the idea turns out to be successful and raises an additional 100M. Post-IPO the company has 10M shares. Assume that the VC cashes out immediately after IPO. (b) What is the share price after IPO at 2017? How many shares are sold to the public? (4 marks) (c) Will the VC contribute the 10M capital in 2016? If so, what is the VC's percentage ownership of the company after the contribution in 2016? Q4c: 120 words (4 marks) Unfortunately markets rarely give a fair valuation. This mis-valuation gives GW the option to choose the ideal timing to go public (so-called 'market timing'). Suppose GW can choose to conduct the IPO in 2017, 2018 or 2019 at prices of 22, 32, and 34 per share respectively. Continue assuming that GW raises an additional 100M at IPO and post-IPO the company has 10M shares. (d) When should GW go public in order to maximize its pre-IPO expected valuation in 2017? Q4d: 180 words (6 marks) (e) Given the possibility to "time the market', redo question (c). (5 marks) (1) Compare what you find in (e) and (e). Is IPO market timing good or bad for efficient project selection? (4 marks) Question 4 Every point in time mentioned in this problem is at the beginning of each year. It is now 2016. Gravitational Waves (GW) Company is a start-up, founded in 2015 with a potentially profitable idea. GW has already spent its 7M endowment over the past year on developing this idea and now the company has a reasonable outlook for it. The idea still requires 10M and one more year to refine before one can definitively see its potential. Unfortunately, GW has run out of money and therefore approaches a VC and asks for a 10M equity contribution. In 2017, GW's idea will be either a complete failure with O value or a great success generating annual earnings of 20M forever starting from 2018. The probability of success is 0.1, and the appropriate discount rate is 20%. Earnings will be paid out as dividends. (a) What's the fair valuation of the company at 2017 after the idea proves to be successful? (2 marks) Now assume that GW goes public in 2017 if the idea turns out to be successful and raises an additional 100M. Post-IPO the company has 10M shares. Assume that the VC cashes out immediately after IPO. (b) What is the share price after IPO at 2017? How many shares are sold to the public? (4 marks) (c) Will the VC contribute the 10M capital in 2016? If so, what is the VC's percentage ownership of the company after the contribution in 2016? Q4c: 120 words (4 marks) Unfortunately markets rarely give a fair valuation. This mis-valuation gives GW the option to choose the ideal timing to go public (so-called 'market timing'). Suppose GW can choose to conduct the IPO in 2017, 2018 or 2019 at prices of 22, 32, and 34 per share respectively. Continue assuming that GW raises an additional 100M at IPO and post-IPO the company has 10M shares. (d) When should GW go public in order to maximize its pre-IPO expected valuation in 2017? Q4d: 180 words (6 marks) (e) Given the possibility to "time the market', redo question (c). (5 marks) (1) Compare what you find in (e) and (e). Is IPO market timing good or bad for efficient project selection? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts