Question: Question 4 Exercise 6-3 Specific identification cost flow assumption LO2 eXcel CHECK FIGURES: COGS = $9.427; Gross profit = $15.073 Refer to the data in

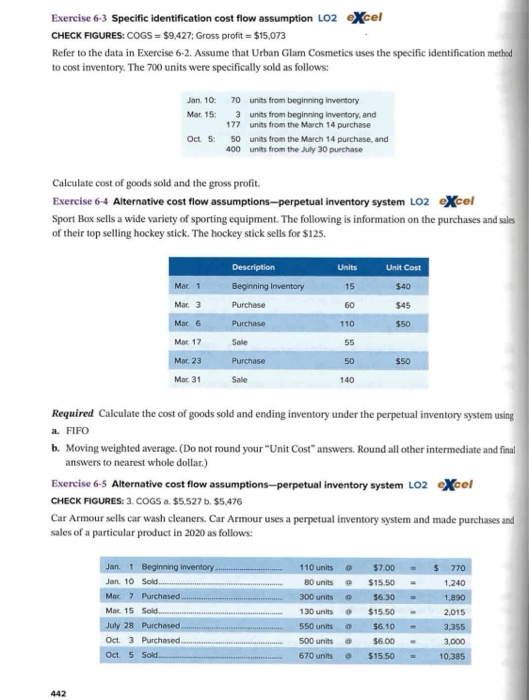

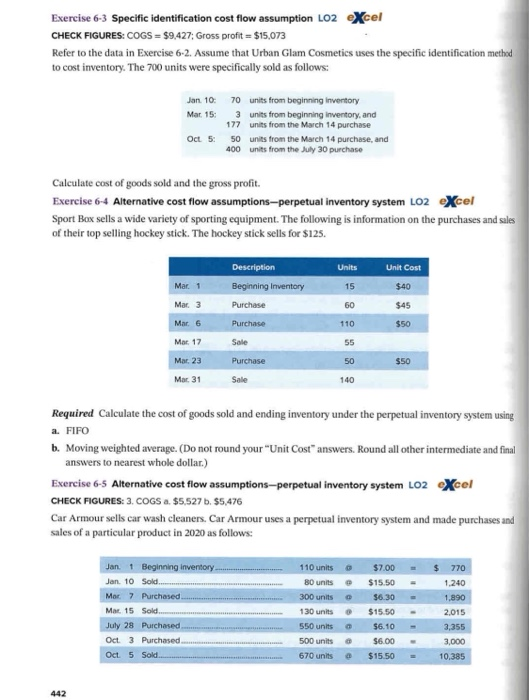

Exercise 6-3 Specific identification cost flow assumption LO2 eXcel CHECK FIGURES: COGS = $9.427; Gross profit = $15.073 Refer to the data in Exercise 6-2. Assume that Urban Glam Cosmetics uses the specific identification method to cost inventory. The 700 units were specifically sold as follows: Jan 10: Mar 15 70 3 177 50 400 units from beginning inventory units from beginning inventory, and units from the March 14 purchase units from the March 14 purchase, and units from the July 30 purchase Oct 5: Calculate cost of goods sold and the gross profit. Exercise 6-4 Alternative cost flow assumptions-perpetual inventory system LO2 excel Sport Box sells a wide variety of sporting equipment. The following is information on the purchases and sales of their top selling hockey stick. The hockey stick sells for $125. Unit Cost Description Beginning Inventory Units 15 Mar. 1 $40 Mar. 3 Purchase $45 Mar. 6 Purchase $50 Mar. 17 Sale Mar. 23 Purchase 50 $50 Mar 31 Sale 140 Required Calculate the cost of goods sold and ending inventory under the perpetual inventory system using a. FIFO b. Moving weighted average. (Do not round your "Unit Cost" answers. Round all other intermediate and final answers to nearest whole dollar.) Exercise 6-5 Alternative cost flow assumptions-perpetual Inventory system LO2 Xcel CHECK FIGURES: 3. COGS a. $5,527 b. $5.476 Car Armour sells car wash cleaners. Car Armour uses a perpetual inventory system and made purchases and sales of a particular product in 2020 as follows: Jan. Beginning inventory....... Jan. 10 Sold. Mar. 7 Purchased......... ... Mar. 15 Sold July 28 Purchased........... Oct. 3 Purchased........ Oct 5 Sold. 110 units 80 units 300 units 130 units 550 units 500 units 670 units $7.00 $15.50 $6.30 $15.50 $6.10 $6.00 $15.50 = - - - - $ 770 1.240 1,890 2.015 3,355 3,000 10.385 @ = Exercise 6-3 Specific identification cost flow assumption LO2 eXcel CHECK FIGURES: COGS = $9.427; Gross profit = $15.073 Refer to the data in Exercise 6-2. Assume that Urban Glam Cosmetics uses the specific identification method to cost inventory. The 700 units were specifically sold as follows: Jan 10: Mar 15 70 3 177 50 400 units from beginning inventory units from beginning inventory, and units from the March 14 purchase units from the March 14 purchase, and units from the July 30 purchase Oct 5: Calculate cost of goods sold and the gross profit. Exercise 6-4 Alternative cost flow assumptions-perpetual inventory system LO2 excel Sport Box sells a wide variety of sporting equipment. The following is information on the purchases and sales of their top selling hockey stick. The hockey stick sells for $125. Unit Cost Description Beginning Inventory Units 15 Mar. 1 $40 Mar. 3 Purchase $45 Mar. 6 Purchase $50 Mar. 17 Sale Mar. 23 Purchase $50 Mar 31 Sale 140 Required Calculate the cost of goods sold and ending inventory under the perpetual inventory system using a. FIFO b. Moving weighted average. (Do not round your "Unit Cost" answers. Round all other intermediate and final answers to nearest whole dollar.) Exercise 6-5 Alternative cost flow assumptions-perpetual Inventory system LO2 Xcel CHECK FIGURES: 3. COGS a. $5,527 b. $5.476 Car Armour sells car wash cleaners. Car Armour uses a perpetual inventory system and made purchases and sales of a particular product in 2020 as follows: @ Jan. - Beginning inventory..... Jan. 10 Sold. Mor 7 Purchased......... ............ MAE 15 Sold July 28 Purchased............ Oct. 3 Purchased......... Oct 5 Sold...... 110 units 80 units 300 units 130 units 550 units 500 units 670 units $7.00 $15.50 $6.30 $15.50 $6.10 $6.00 $15.50 = - = - - - = $ 770 1.240 1,890 2.015 3,355 3,000 10,385 @

Step by Step Solution

There are 3 Steps involved in it

I will now analyze the images and answer all the questions based on the provided exercises I have analyzed the images and I will now provide solutions to all the required calculations Exercise 63 Spec... View full answer

Get step-by-step solutions from verified subject matter experts