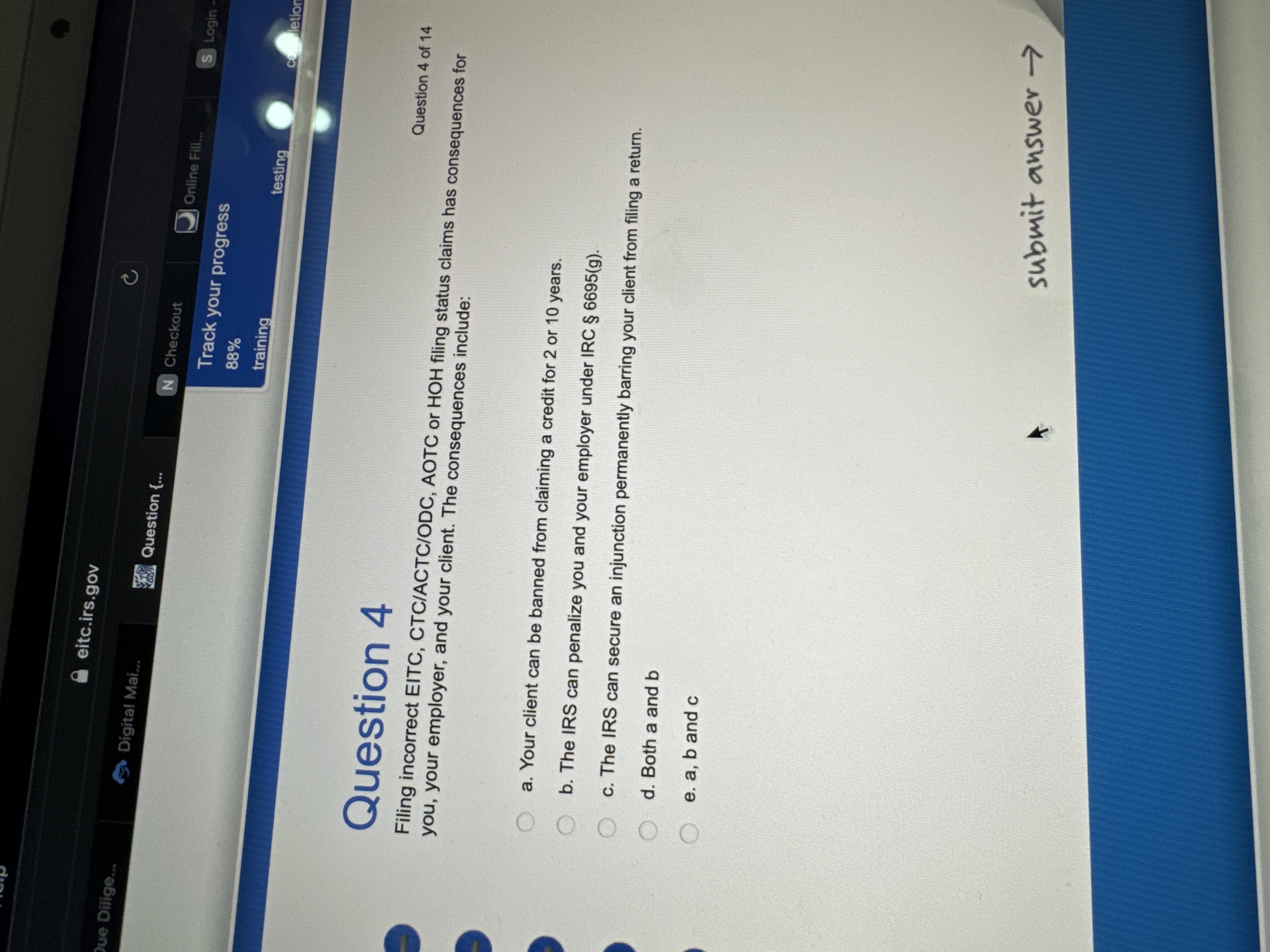

Question: Question 4 Filing incorrect EITC, CTC / ACTC / ODC , AOTC or HOH you, your employer, and your client. The consequences filing status claims

Question Filing incorrect EITC, CTCACTCODC AOTC or HOH you, your employer, and your client. The consequences filing status claims has consequences for a Your client can be banned from claiming a credit for or years. b The IRS can penalize you and your employer under IRC g c The IRS can secure an injunction permanently barring your client from filing a return. d Both a and e a b and c

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock