Question: Question 4 - Financial Statement Analysis (15 marks) Chef Z Inc. was approached by Bakers Inc. to provide an equity investment in their business. They

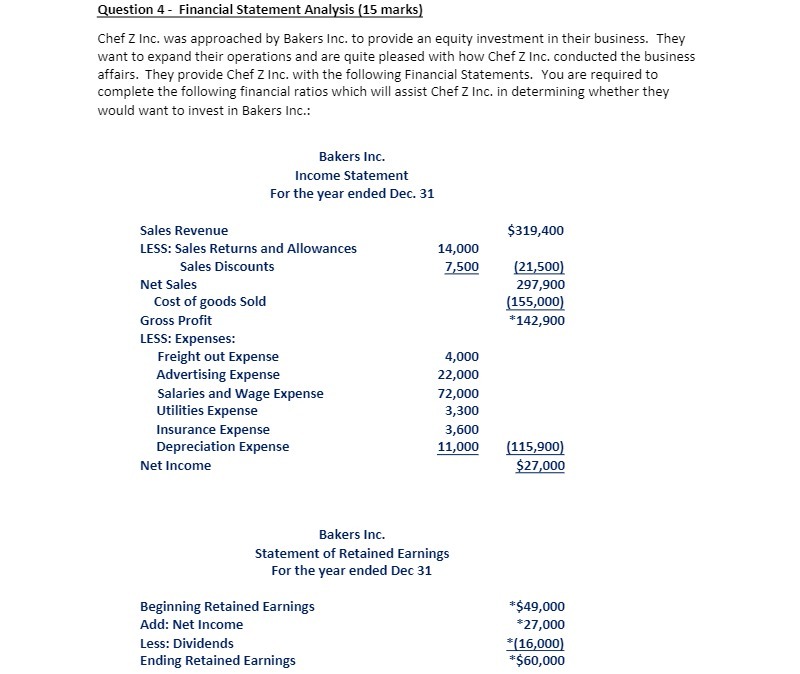

Question 4 - Financial Statement Analysis (15 marks) Chef Z Inc. was approached by Bakers Inc. to provide an equity investment in their business. They want to expand their operations and are quite pleased with how Chef Z Inc. conducted the business affairs. They provide Chef Z Inc. with the following Financial Statements. You are required to complete the following financial ratios which will assist Chef Z Inc. in determining whether they would want to invest in Bakers Inc.: Bakers Inc. Income Statement For the year ended Dec. 31 Sales Revenue $319,400 LESS: Sales Returns and Allowances 14,000 Sales Discounts 7,500 (21,500) Net Sales 297,900 Cost of goods Sold (155,000) Gross Profit *142,900 LESS: Expenses: Freight out Expense 4,000 Advertising Expense 22,000 Salaries and Wage Expense 72,000 Utilities Expense 3,300 Insurance Expense 3,600 Depreciation Expense 11,000 (115,900) Net Income $27,000 Bakers Inc. Statement of Retained Earnings For the year ended Dec 31 Beginning Retained Earnings *$49,000 Add: Net Income #27,000 Less: Dividends *(16,000) Ending Retained Earnings *$60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts