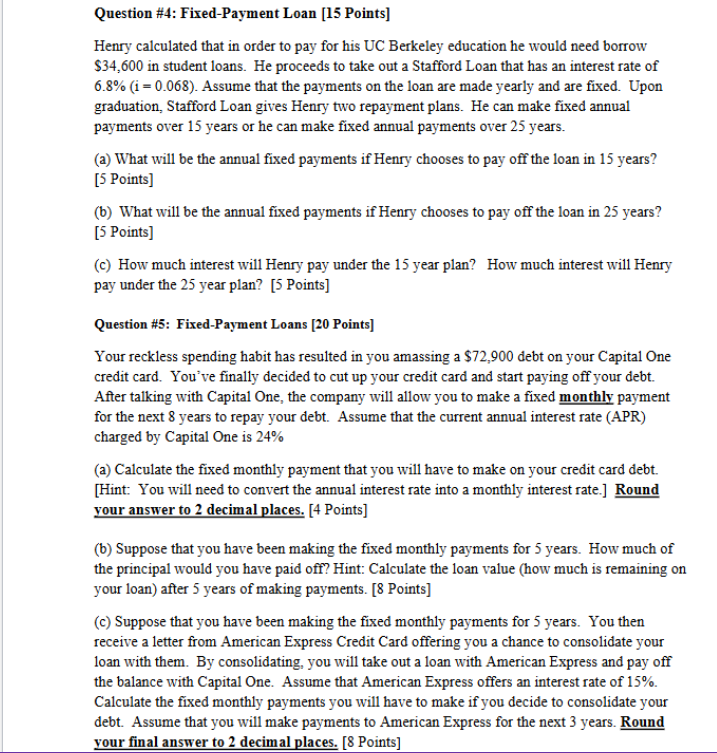

Question: Question # 4 : Fixed - Payment Loan [ 1 5 Points ] Henry calculated that in order to pay for his UC Berkeley education

Question #: FixedPayment Loan Points

Henry calculated that in order to pay for his UC Berkeley education he would need borrow

$ in student loans. He proceeds to take out a Stafford Loan that has an interest rate of

i Assume that the payments on the loan are made yearly and are fixed. Upon

graduation, Stafford Loan gives Henry two repayment plans. He can make fixed annual

payments over years or he can make fixed annual payments over years.

a What will be the annual fixed payments if Henry chooses to pay off the loan in years?

Points

b What will be the annual fixed payments if Henry chooses to pay off the loan in years?

Points

c How much interest will Henry pay under the year plan? How much interest will Henry

pay under the year plan? Points

Question #: FixedPayment Loans Points

Your reckless spending habit has resulted in you amassing a $ debt on your Capital One

credit card. You've finally decided to cut up your credit card and start paying off your debt.

After talking with Capital One, the company will allow you to make a fixed monthly payment

for the next years to repay your debt. Assume that the current annual interest rate APR

charged by Capital One is

a Calculate the fixed monthly payment that you will have to make on your credit card debt.

Hint: You will need to convert the annual interest rate into a monthly interest rate. Round

your answer to decimal places. Points

b Suppose that you have been making the fixed monthly payments for years. How much of

the principal would you have paid off? Hint: Calculate the loan value how much is remaining on

your loan after years of making payments. Points

c Suppose that you have been making the fixed monthly payments for years. You then

receive a letter from American Express Credit Card offering you a chance to consolidate your

loan with them. By consolidating, you will take out a loan with American Express and pay off

the balance with Capital One. Assume that American Express offers an interest rate of

Calculate the fixed monthly payments you will have to make if you decide to consolidate your

debt. Assume that you will make payments to American Express for the next years. Round

your final answer to decimal places. Points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock