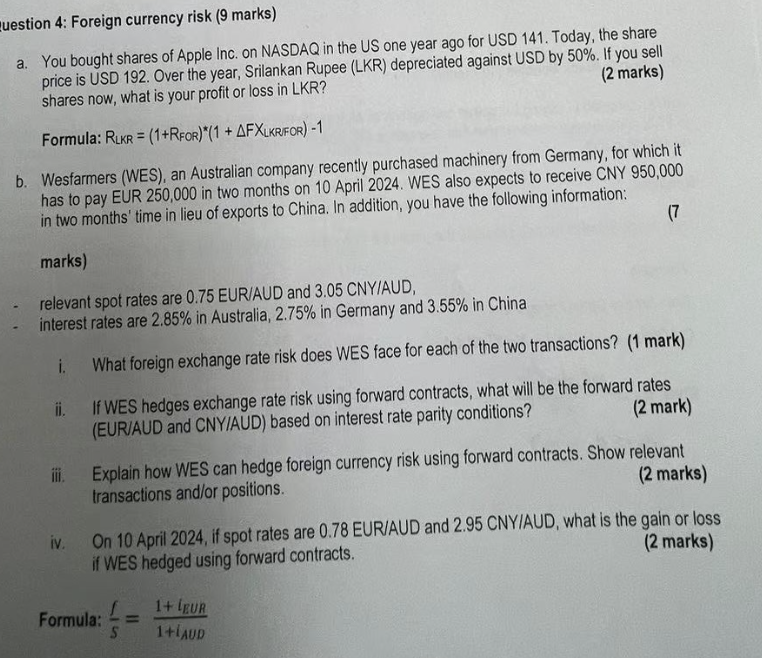

Question: question 4 : Foreign currency risk a . You bought shares of Apple Inc. on NASDAQ in the US one year ago for USD 1

question : Foreign currency risk

a You bought shares of Apple Inc. on NASDAQ in the US one year ago for USD Today, the share price is USD Over the year, Srilankan Rupee LKR depreciated against USD by If you sell shares now, what is your profit or loss in LKR

Formula: RL K RleftRF O RrightleftDelta F XL K R F O Rright

b Wesfarmers WES an Australian company recently purchased machinery from Germany, for which it has to pay EUR in two months on April WES also expects to receive CNY in two months' time in lieu of exports to China. In addition, you have the following information:

marks

relevant spot rates are EURAUD and CNYAUD

interest rates are in Australia, in Germany and in China

i What foreign exchange rate risk does WES face for each of the two transactions? mark

ii If WES hedges exchange rate risk using forward contracts, what will be the forward rates EURAUD and CNYIAUD based on interest rate parity conditions?

iii. Explain how WES can hedge foreign currency risk using forward contracts. Show relevant transactions andor positions.

iv On April if spot rates are EURIAUD and CNYIAUD, what is the gain or loss if WES hedged using forward contracts.

Formula: fracfsfraciE U RiA U D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock