Question: Question 4 Here are the returns on Azmn and Mist stocks over the past five months: AZMN JANUARY FEBRUARY MARCH APRIL 15% -3% 7% MEST

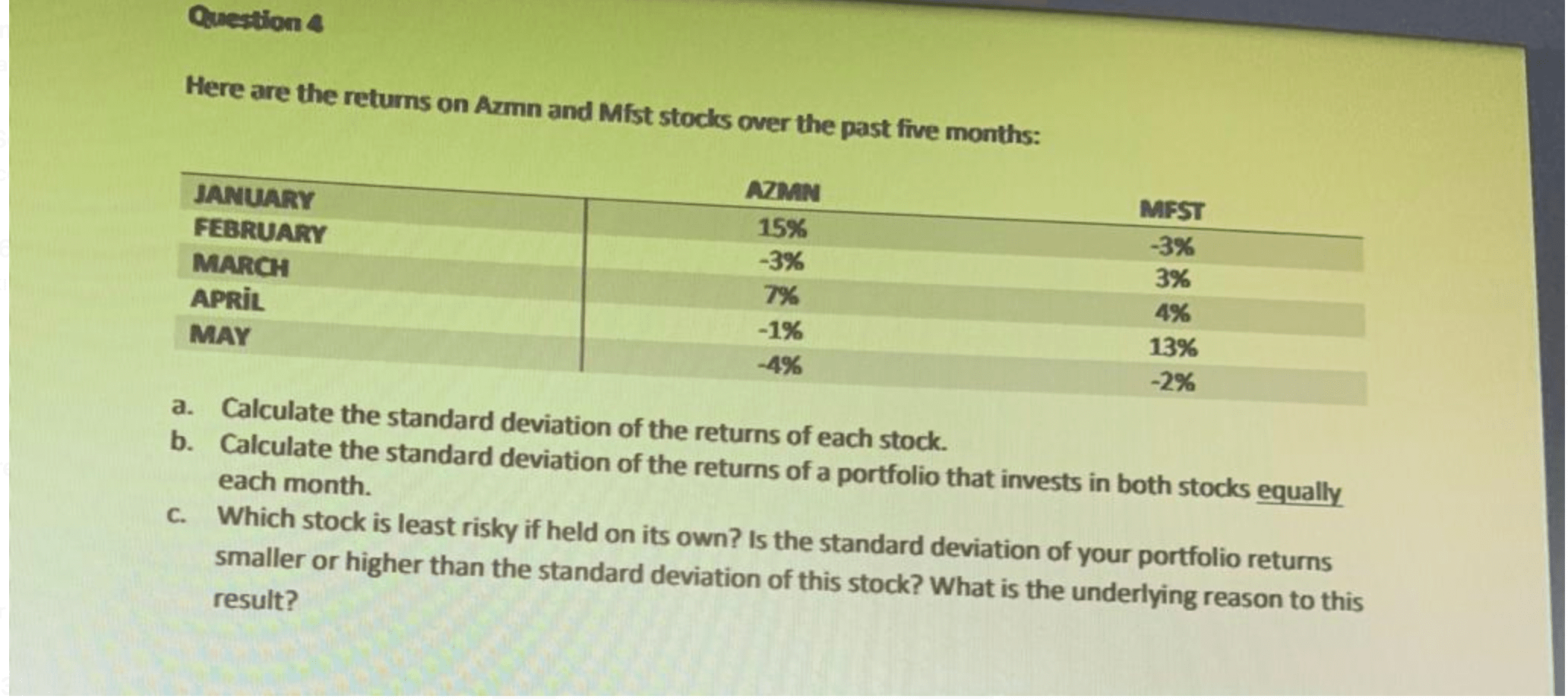

Question 4 Here are the returns on Azmn and Mist stocks over the past five months: AZMN JANUARY FEBRUARY MARCH APRIL 15% -3% 7% MEST -3% 3% 4% MAY -1% -4% 13% -2% a. Calculate the standard deviation of the returns of each stock. b. Calculate the standard deviation of the returns of a portfolio that invests in both stocks equally each month. Which stock is least risky if held on its own? Is the standard deviation of your portfolio returns smaller or higher than the standard deviation of this stock? What is the underlying reason to this result? C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock