Question: QUESTION 4 IS DONE I JUST NEED QUESTION 5. QUESTION 4 IS JUST THERE FOR REFERENCE 0 1 17000 4. (10) Points The Big Company

QUESTION 4 IS DONE I JUST NEED QUESTION 5. QUESTION 4 IS JUST THERE FOR REFERENCE

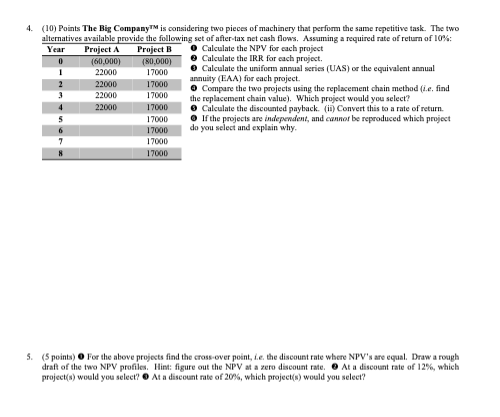

0 1 17000 4. (10) Points The Big Company is considering two pieces of machinery that perform the same repetitive task. The two alternatives available provide the following set of after-tax net cash flows. Assuming a required rate of return of 10%: Year Project A Project B Calculate the NPV for each project (60.000) (80,000) Calculate the IRR for each project 22000 Calculate the uniform annual series (UAS) or the equivalent annual annuity (EAA) for each project. 17000 Compare the two projects using the replacement chain method (ie, find the replacement chain value). Which project would you select? 17000 Calculate the discounted payback (in) Convert this to a rate of return. If the projects are independent, and cannor be reproduced which project 17000 do you select and explain why 17000 2 22000 3 22000 17000 4 22000 5 17000 17000 S. (5 points) For the above projects find the crossover point, ie the discount rate where NPV's are equal. Draw a rough draft of the two NPV profiles Hint: figure out the NPV at a raro discount rate. At a discount rate of 12%, which project(s) would you select? At a discount rate of 20%, which project(s) would you select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts