Question: Question 4 Jack Brown, a sell - side analyst covering ABC Plc , is updating his valuation estimates following the company's recent results announcement. The

Question

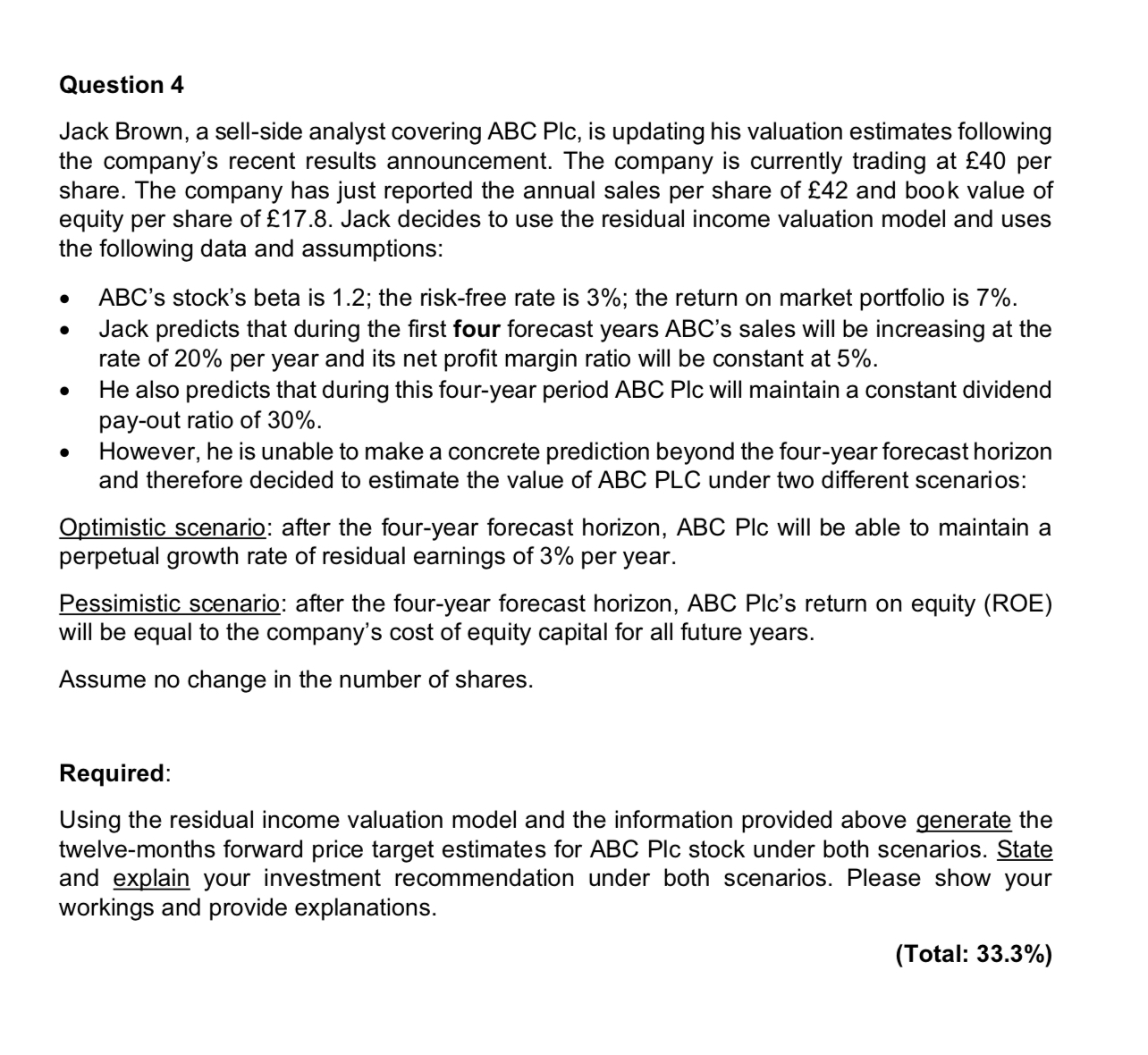

Jack Brown, a sellside analyst covering ABC Plc is updating his valuation estimates following the company's recent results announcement. The company is currently trading at per share. The company has just reported the annual sales per share of and book value of equity per share of Jack decides to use the residual income valuation model and uses the following data and assumptions:

ABC's stock's beta is ; the riskfree rate is ; the return on market portfolio is

Jack predicts that during the first four forecast years ABC's sales will be increasing at the rate of per year and its net profit margin ratio will be constant at

He also predicts that during this fouryear period ABC Plc will maintain a constant dividend payout ratio of

However, he is unable to make a concrete prediction beyond the fouryear forecast horizon and therefore decided to estimate the value of ABC PLC under two different scenarios:

Optimistic scenario: after the fouryear forecast horizon, ABC PIc will be able to maintain a perpetual growth rate of residual earnings of per year.

Pessimistic scenario: after the fouryear forecast horizon, ABC Plcs return on equity ROE will be equal to the company's cost of equity capital for all future years.

Assume no change in the number of shares.

Required:

Using the residual income valuation model and the information provided above generate the twelvemonths forward price target estimates for ABC Plc stock under both scenarios. State and explain your investment recommendation under both scenarios. Please show your workings and provide explanations.

Total:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock