Question: Question 4 Jamie Ltd is looking into some potential investment projects. Relevant information is summarised below: Project Poppy Cost of Investment $600,000 Estimated net cash

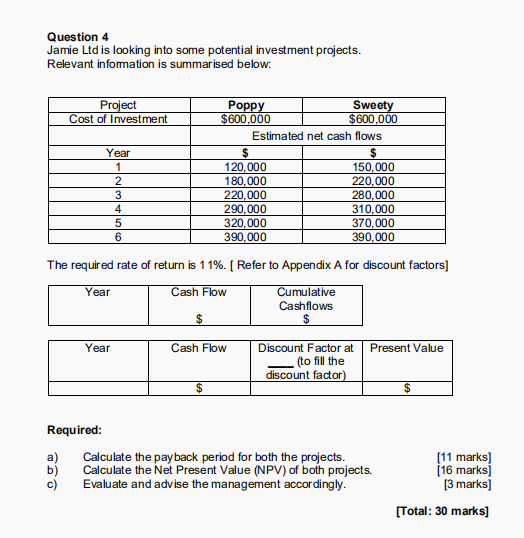

Question 4 Jamie Ltd is looking into some potential investment projects. Relevant information is summarised below: Project Poppy Cost of Investment $600,000 Estimated net cash flows Year $ $ 1 120,000 150,000 2 180,000 220,000 3 220,000 280,000 4 290,000 310,000 5 320,000 370,000 6 390,000 390,000 The required rate of return is 11%. [ Refer to Appendix A for discount factors] Year Cash Flow Cumulative Cashflows $ Year Cash Flow Discount Factor at Present Value (to fill the discount factor) $ $ Calculate the payback period for both the projects. Calculate the Net Present Value (NPV) of both projects. Evaluate and advise the management accordingly. Required: a) b) c) Sweety $600,000 [11 marks] [16 marks] [3 marks] [Total: 30 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts