Question: QUESTION 4 Like many large-cap tech stocks, Uber does not currently pay dividends to its shareholders and is unlikely to initiate a dividend stream soon

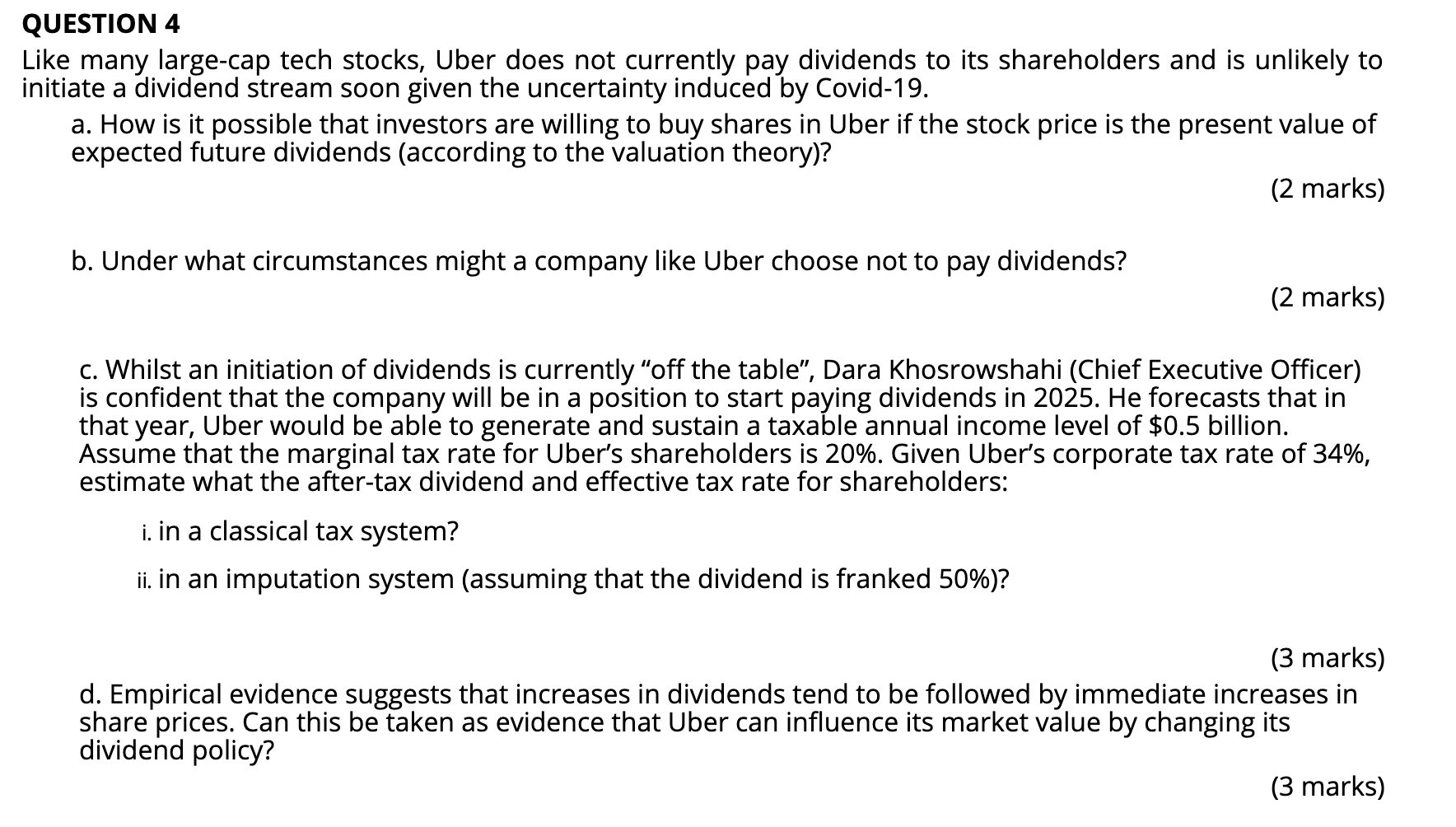

QUESTION 4 Like many large-cap tech stocks, Uber does not currently pay dividends to its shareholders and is unlikely to initiate a dividend stream soon given the uncertainty induced by Covid-19. a. How is it possible that investors are willing to buy shares in Uber if the stock price is the present value of expected future dividends (according to the valuation theory)? (2 marks) b. Under what circumstances might a company like Uber choose not to pay dividends? (2 marks) C. Whilst an initiation of dividends is currently off the table, Dara Khosrowshahi (Chief Executive Officer) is confident that the company will be in a position to start paying dividends in 2025. He forecasts that in that year, Uber would be able to generate and sustain a taxable annual income level of $0.5 billion. Assume that the marginal tax rate for Uber's shareholders is 20%. Given Uber's corporate tax rate of 34%, estimate what the after-tax dividend and effective tax rate for shareholders: i. in a classical tax system? ii. in an imputation system (assuming that the dividend is franked 50%)? (3 marks) d. Empirical evidence suggests that increases in dividends tend to be followed by immediate increases in share prices. Can this be taken as evidence that Uber can influence its market value by changing its dividend policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts