Question: Question 4: Long-term assets (Total 15 marks) Part A -Cost of Plant Assets (7 marks) Fiesta Company purchased a special purpose machine on 1

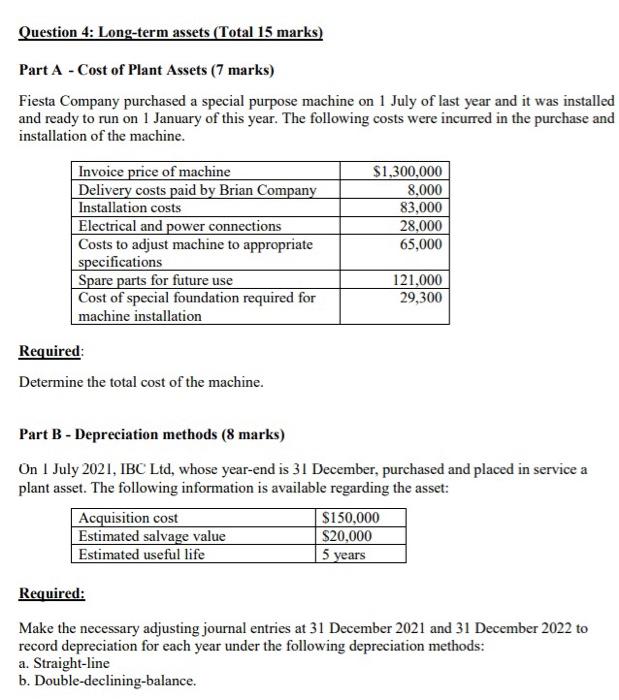

Question 4: Long-term assets (Total 15 marks) Part A -Cost of Plant Assets (7 marks) Fiesta Company purchased a special purpose machine on 1 July of last year and it was installed and ready to run on 1 January of this year. The following costs were incurred in the purchase and installation of the machine. Invoice price of machine Delivery costs paid by Brian Company Installation costs $1,300,000 8,000 83,000 Electrical and power connections 28,000 Costs to adjust machine to appropriate 65,000 specifications Spare parts for future use 121,000 Cost of special foundation required for machine installation 29,300 Required: Determine the total cost of the machine. Part B - Depreciation methods (8 marks) On 1 July 2021, IBC Ltd, whose year-end is 31 December, purchased and placed in service a plant asset. The following information is available regarding the asset: Acquisition cost Estimated salvage value Estimated useful life Required: $150,000 $20,000 5 years Make the necessary adjusting journal entries at 31 December 2021 and 31 December 2022 to record depreciation for each year under the following depreciation methods: a. Straight-line b. Double-declining-balance.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts