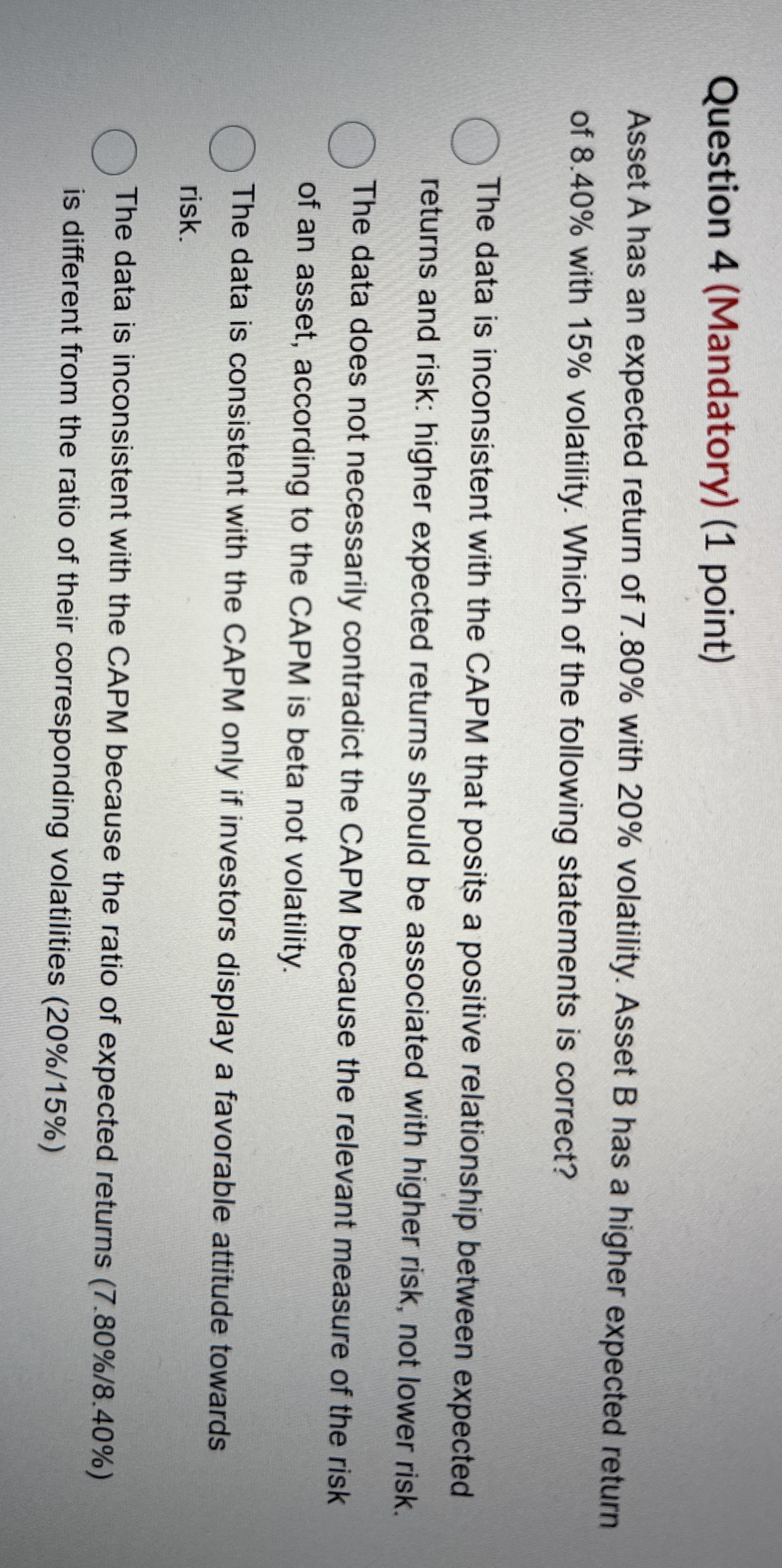

Question: Question 4 ( Mandatory ) ( 1 point ) Asset A has an expected return of 7 . 8 0 % with 2 0 %

Question Mandatory point

Asset A has an expected return of with volatility. Asset has a higher expected return of with volatility. Which of the following statements is correct?

The data is inconsistent with the CAPM that posits a positive relationship between expected returns and risk: higher expected returns should be associated with higher risk, not lower risk.

The data does not necessarily contradict the CAPM because the relevant measure of the risk of an asset, according to the CAPM is beta not volatility.

The data is consistent with the CAPM only if investors display a favorable attitude towards risk.

The data is inconsistent with the CAPM because the ratio of expected returns is different from the ratio of their corresponding volatilities

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock