Question: Question 4 (Mandatory) (1.5 points) Suppose that BBM Industries, Inc. currently has the balance sheet shown as follows. and that sales for the year just

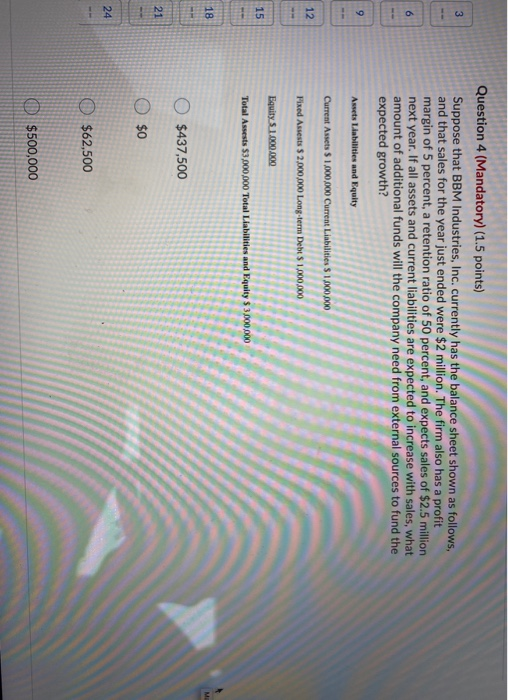

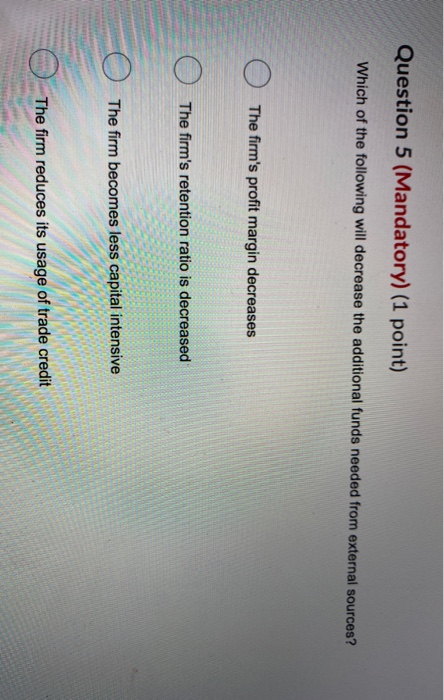

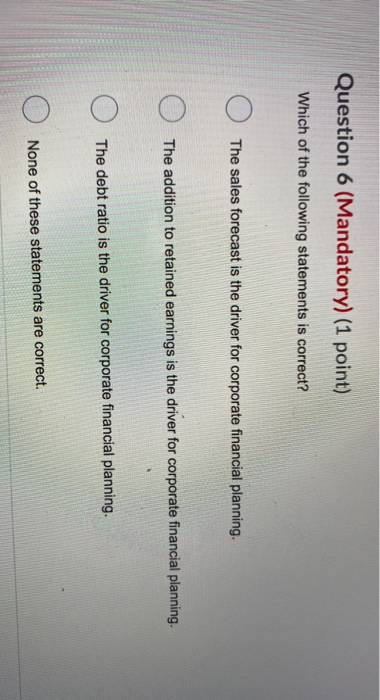

Question 4 (Mandatory) (1.5 points) Suppose that BBM Industries, Inc. currently has the balance sheet shown as follows. and that sales for the year just ended were $2 million. The firm also has a profit margin of 5 percent, a retention ratio of 50 percent, and expects sales of $2.5 million next year. If all assets and current liabilities are expected to increase with sales, what amount of additional funds will the company need from external sources to fund the expected growth? Assets Liabilities and Equity Current Assets Current Liabilities S 100 Fixed Assets $ 2.000.000 Long-term Debt 51.000.000 Equity 5.1.000.000 Total Assets $3,000,000 Total Liab $437,500 $0 $62,500 O $500,000 Question 5 (Mandatory) (1 point) Which of the following will decrease the additional funds needed from external sources? The firm's profit margin decreases The firm's retention ratio is decreased 0 The firm becomes less capital intensive WW The firm reduces its usage of trade credit Question 6 (Mandatory) (1 point) Which of the following statements is correct? The sales forecast is the driver for corporate financial planning. The addition to retained earnings is the driver for corporate financial planning. The debt ratio is the driver for corporate financial planning. None of these statements are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts