Question: Question 4: MS Systems (MSS) has developed a new security device using chewing gum-imaging technology (CIT) for identification purposes. The company officials were convinced that

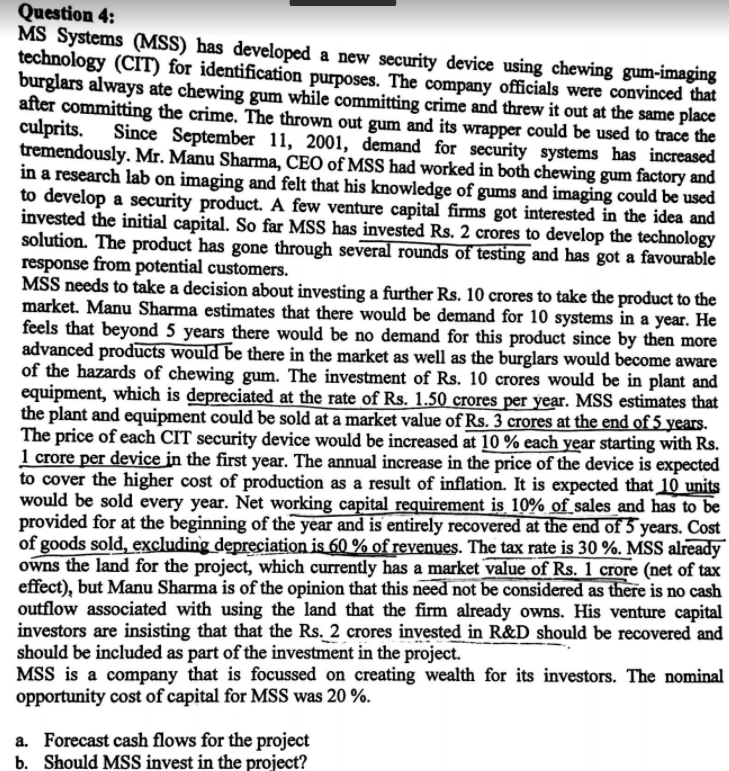

Question 4: MS Systems (MSS) has developed a new security device using chewing gum-imaging technology (CIT) for identification purposes. The company officials were convinced that burglars always ate chewing gum while committing crime and threw it out at the same place after committing the crime. The thrown out gum and its wrapper could be used to trace the culprits. Since September 11, 2001, demand for security systems has increased tremendously. Mr. Manu Sharma, CEO of MSS had worked in both chewing gum factory and in a research lab on imaging and felt that his knowledge of gums and imaging could be used to develop a security product. A few venture capital firms got interested in the idea and invested the initial capital. So far MSS has invested Rs. 2 crores to develop the technology solution. The product has gone through several rounds of testing and has got a favourable response from potential customers. MSS needs to take a decision about investing a further Rs. 10 crores to take the product to the market. Manu Sharma estimates that there would be demand for 10 systems in a year. He feels that beyond 5 years there would be no demand for this product since by then more advanced products would be there in the market as well as the burglars would become aware of the hazards of chewing gum. The investment of Rs. 10 crores would be in plant and equipment, which is depreciated at the rate of Rs. 1.50 crores per year. MSS estimates that the plant and equipment could be sold at a market value of Rs. 3 crores at the end of 5 years. The price of each CIT security device would be increased at 10 % each year starting with Rs. 1 crore per device in the first year. The annual increase in the price of the device is expected to cover the higher cost of production as a result of inflation. It is expected that 10 units would be sold every year. Net working capital requirement is 10% of sales and has to be provided for at the beginning of the year and is entirely recovered at the end of 5 years. Cost of goods sold, excluding depreciation is 60 % of revenues. The tax rate is 30 %. MSS already owns the land for the project, which currently has a market value of Rs. 1 crore (net of tax effect), but Manu Sharma is of the opinion that this need not be considered as there is no cash outflow associated with using the land that the firm already owns. His venture capital investors are insisting that that the Rs. 2 crores invested in R&D should be recovered and should be included as part of the investment in the project. MSS is a company that is focussed on creating wealth for its investors. The nominal opportunity cost of capital for MSS was 20 %. a. Forecast cash flows for the project b. Should MSS invest in the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts