Question: Question 4 Naty QUESTION Answer the problem below: All parts are related Mano 1.00 Consider a year to maturity Coupon bond with Face Value -

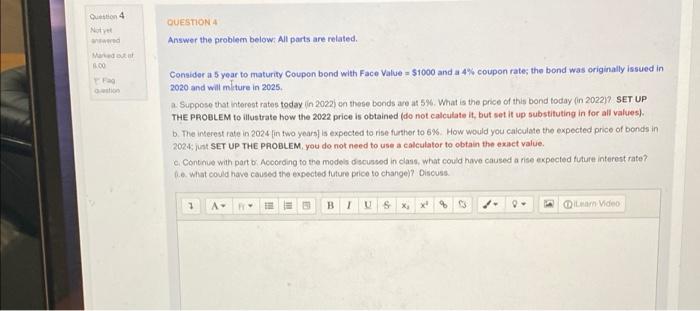

Question 4 Naty QUESTION Answer the problem below: All parts are related Mano 1.00 Consider a year to maturity Coupon bond with Face Value - 51000 and a 4% coupon rate; the bond was originally issued in 2020 and will miture in 2025 Suppose that interest rates today in 2022) on these bonds are at 5% What is the price of this bond today (in 2022) SET UP THE PROBLEM to illustrate how the 2022 price is obtained (do not calculate it, but set it up substituting in for all values). b. The interest rate in 2024 in two years) is expected to rise further to 6% How would you calculate the expected price of bonds in 2024 SET UP THE PROBLEM, you do not need to use a calculator to obtain the exact value. o Contrue with part d' According to the models discussed in class, what could have caused are expected future interest rate? .. what could have caused the expected future price to change? Discuss 1 A 1 %3 Video

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts