Question: Question 4 Note: For each calculation step ( including intermediate steps ) , retain two decimal places without rounding. Provide your final answers with two

Question

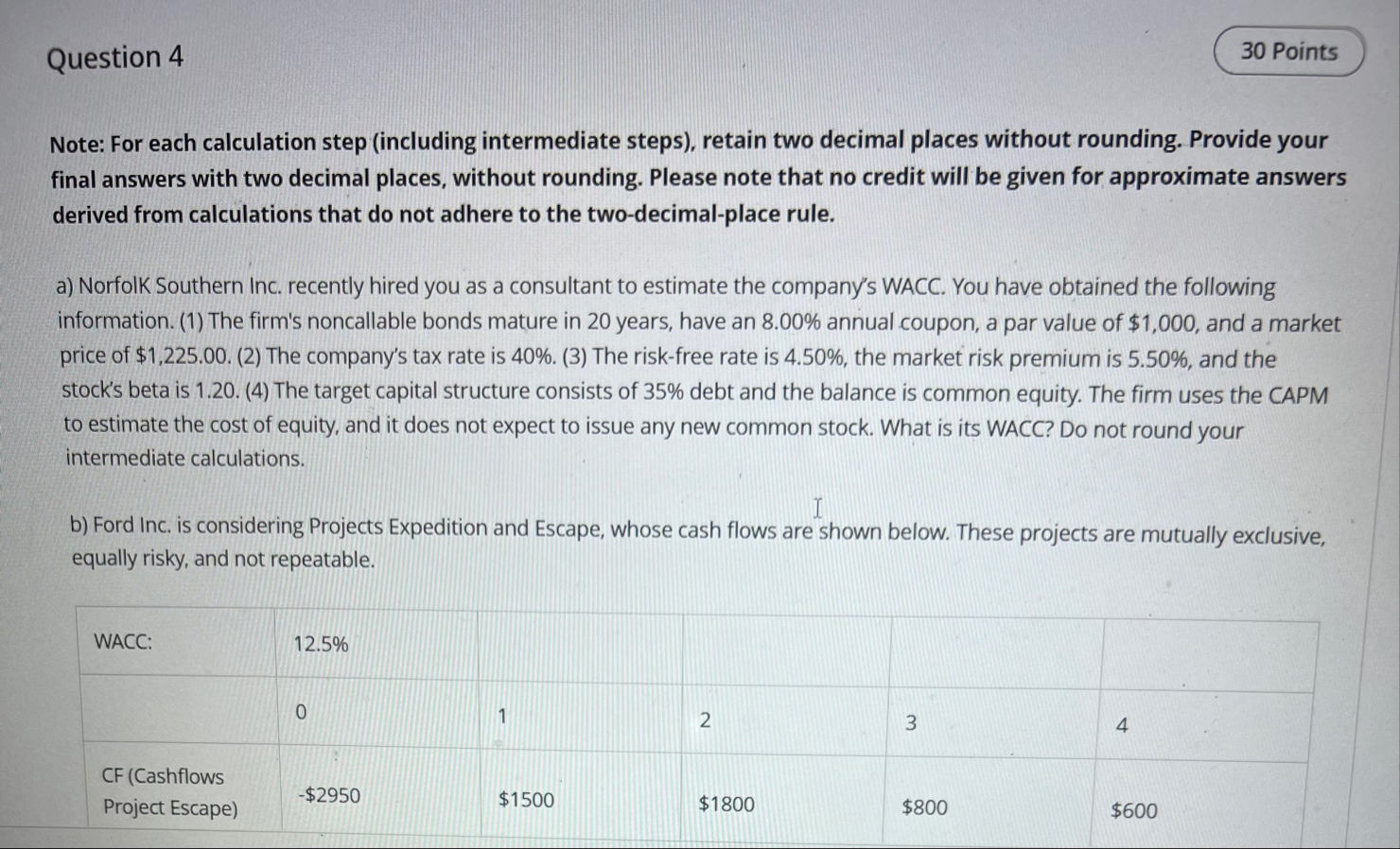

Note: For each calculation step including intermediate steps retain two decimal places without rounding. Provide your final answers with two decimal places, without rounding. Please note that no credit will be given for approximate answers derived from calculations that do not adhere to the twodecimalplace rule.

a NorfolK Southern Inc. recently hired you as a consultant to estimate the company's WACC. You have obtained the following information. The firm's noncallable bonds mature in years, have an annual coupon, a par value of $ and a market price of $ The company's tax rate is The riskfree rate is the market risk premium is and the stock's beta is The target capital structure consists of debt and the balance is common equity. The firm uses the CAPM to estimate the cost of equity, and it does not expect to issue any new common stock. What is its WACC? Do not round your intermediate calculations.

b Ford Inc. is considering Projects Expedition and Escape, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable.

tableWACC:CF Cashflows Project Escape$$$$$

to estimate the cost of equity, and it does not expect to issue any new common stock. What is its WACC? Do not round your intermediate calculations.

b Ford Inc. is considering Projects Expedition and Escape, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable.

tableWACC:CF Cashflows Project Escape$$$$$CF Cashflow Project Expedition$$$$$

a What are the NPV and IRR of the project Escape?

b What are the NPV and IRR of the project Expedition?

c What are the payback periods for Project Escape and Expedition?

If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock