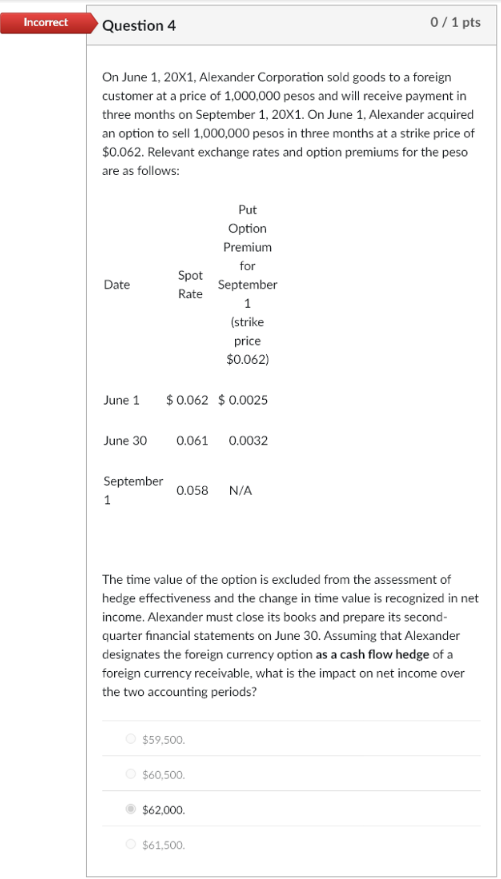

Question: Question 4 O n June 1 , 2 0 X 1 , Alexander Corporation sold goods t o a foreign customer a t a price

Question

June Alexander Corporation sold goods a foreign

customer a price pesos and will receive payment

three months September June Alexander acquired

option sell pesos three months a strike price

$ Relevant exchange rates and option premiums for the peso

are follows:

June $$

June

September

The time value the option excluded from the assessment

hedge effectiveness and the change time value recognized net

income. Alexander must close its books and prepare its second

quarter financial statements June Assuming that Alexander

designates the foreign currency option a cash flow hedge

foreign currency receivable, what the impact net income over

the two accounting periods?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock