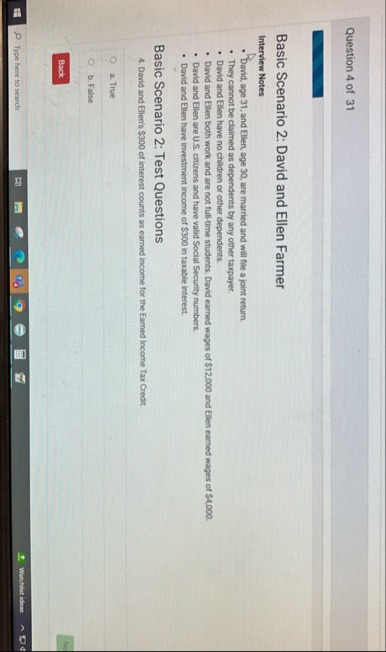

Question: Question 4 of 3 1 Basic Scenario 2 : David and Ellen Farmer Interview Notes David, age 3 1 , and Ellen, age 3 0

Question of

Basic Scenario : David and Ellen Farmer

Interview Notes

David, age and Ellen, age are married and will flie a joint return.

They cannot be claimed as dependents by any other taxpayer.

David and Ellen have no children or other dependents.

David and Ellen both work and are not fulltime students. David earned wages of $ and Ellen earned wages of $

David and Ellen are US citizens and have valid Social Security numbers.

David and Ellen have investment income of $ in taxable interest.

Basic Scenario : Test Questions

David and Ellen's $ of interest counts as earned income for the Earned Income Tax Credit.

a True

b Talse

Type here to search

Whathlat alrom

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock