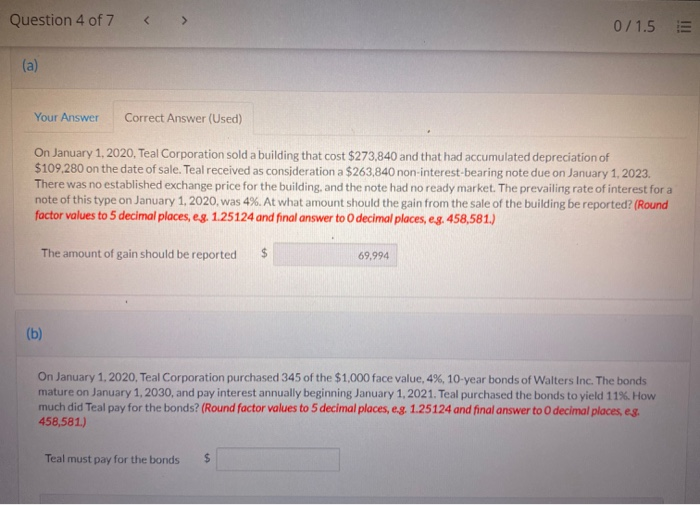

Question: Question 4 of 7 0/1.5 E (a) Your Answer Correct Answer (Used) On January 1, 2020, Teal Corporation sold a building that cost $273,840 and

Question 4 of 7 0/1.5 E (a) Your Answer Correct Answer (Used) On January 1, 2020, Teal Corporation sold a building that cost $273,840 and that had accumulated depreciation of $109,280 on the date of sale. Teal received as consideration a $263,840 non-interest-bearing note due on January 1, 2023. There was no established exchange price for the building, and the note had no ready market. The prevailing rate of interest for a note of this type on January 1, 2020, was 4%. At what amount should the gain from the sale of the building be reported? (Round factor values to 5 decimal places, eg. 1.25124 and final answer to decimal places, e.g. 458,581.) The amount of gain should be reported $ 69,994 (b) On January 1, 2020, Teal Corporation purchased 345 of the $1,000 face value, 4%, 10-year bonds of Walters Inc. The bonds mature on January 1, 2030, and pay interest annually beginning January 1, 2021. Teal purchased the bonds to yield 11%. How much did Teal pay for the bonds? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to decimal places, eg. 458,581.) Teal must pay for the bonds $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts