Question: Question 4 On 1 January 2 0 2 3 . Delta Lid entered into a lease agreement for specialized equipment to be used in its

Question

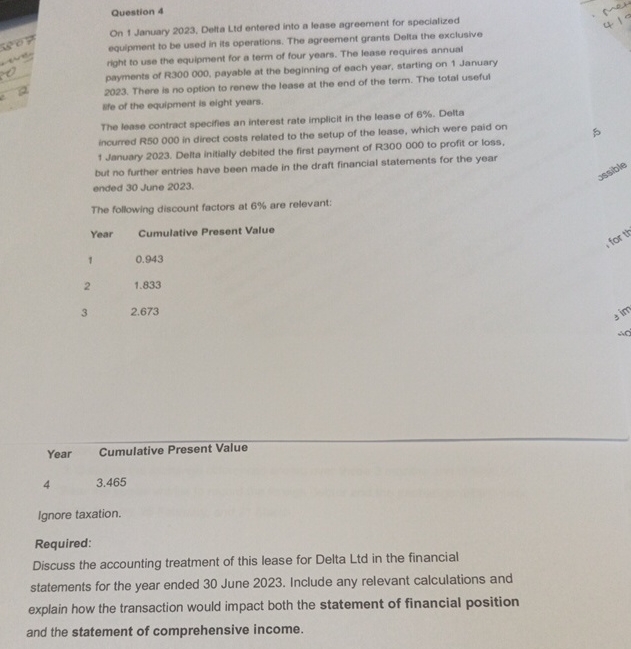

On January Delta Lid entered into a lease agreement for specialized equipment to be used in its operations. The agreement grants Delta the exclusive right to use the equipment for a term of four years. The lease requires annual payments of R payable at the beginning of each year, starting on January There is no option to renew the lease at the end of the term. The total useful ste of the equipment is eight years.

The lease contract specifies an interest rate implicit in the lease of Delta incurred R in direct costs related to the setup of the lease, which were paid on January Delta initiatly debited the first payment of R to profit or loss. but no further entries have been made in the draft financial statements for the year ended June

The following discount factors at are relevant:

tableYearCumulative Present Value

Year Cumulative Present Value

Ignore taxation.

Required:

Discuss the accounting treatment of this lease for Delta Ltd in the financial statements for the year ended June Include any relevant calculations and explain how the transaction would impact both the statement of financial position and the statement of comprehensive income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock