Question: Question 4 options high or low large or small 2 of 6 ID: FMTH.RR.ERVS.02A You own a portfolio that comprises 2 assets . 1,000 shares

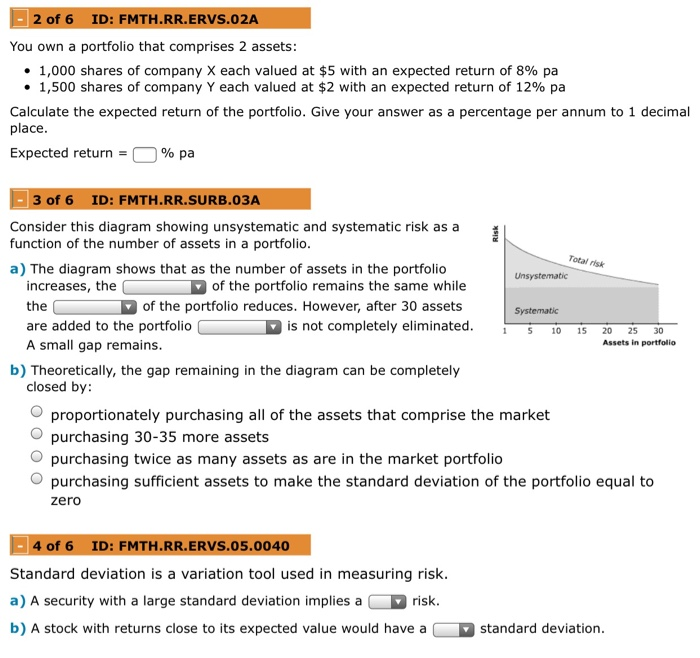

2 of 6 ID: FMTH.RR.ERVS.02A You own a portfolio that comprises 2 assets . 1,000 shares of company X each valued at $5 with an expected return of 8% pa 1,500 shares of company Y each valued at $2 with an expected return of 12% pa Calculate the expected return of the portfolio. Give your answer as a percentage per annum to 1 decimal place Expected return = 096 pa 3 of 6 ID: FMTH.RR.SURB.0 Consider this diagram showing unsystematic and systematic risk as a function of the number of assets in a portfolio a) The diagram shows that as the number of assets in the portfolio Total risk increases, the of the portfolio remains the same while the of the portfolio reduces. However, after 30 assets are added to the portfolio is not completely eliminated. 0 15 20 25 50 A small gap remains Systematic Assets in portfolio b) Theoretically, the gap remaining in the diagram can be completely closed by O proportionately purchasing all of the assets that comprise the market purchasing 30-35 more assets O purchasing twice as many assets as are in the market portfolio O purchasing sufficient assets to make the standard deviation of the portfolio equal to zero 4 of 6 ID: FMTH.RR.ERVS.05.0040 Standard deviation is a variation tool used in measuring risk a) A security with a large standard deviation implies a risk b) A stock with returns close to its expected value would have standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts