Question: Question 4 , P 1 2 - 1 2 ( similar to ) HW Score: 5 5 % , 2 2 of 4 0 points

Question Psimilar to

HW Score: of points

Part of

Points: of client. Boardman has enough money to build either type of plant, and, in the absence of risk differences, accepts the project with the highest NPV The cost of capital is

a Find the NPV for each project. Are the projects acceptable?

b Find the breakeven cash inflow for each project.

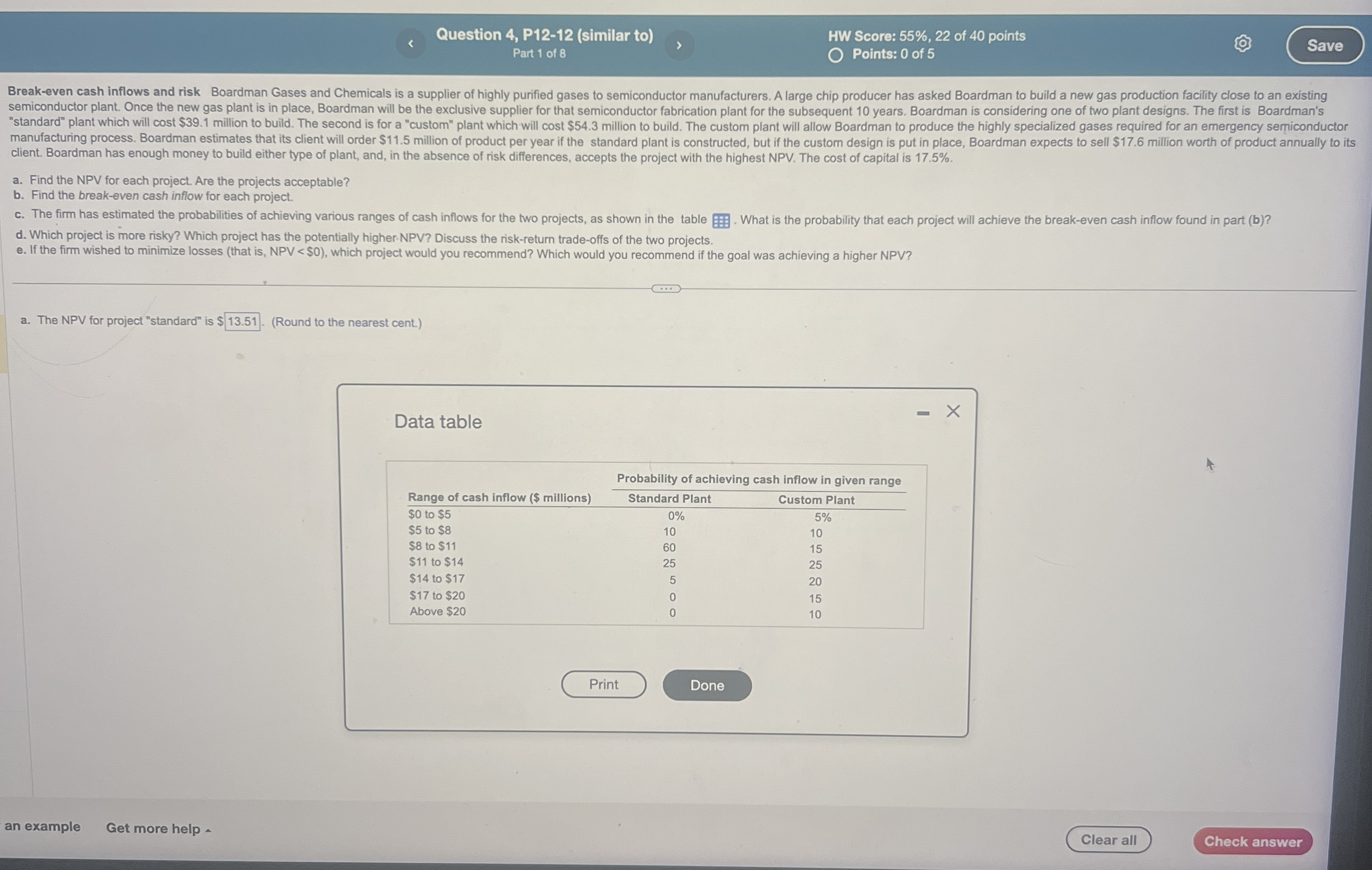

c The firm has estimated the probabilities of achieving various ranges of cash inflows for the two projects, as shown in the table What is the probability that each project will achieve the breakeven cash inflow found in part b

d Which project is more risky? Which project has the potentially higher NPV Discuss the riskreturn tradeoffs of the two projects.

e If the firm wished to minimize losses that is NPV $ which project would you recommend? Which would you recommend if the goal was achieving a higher NPV

a The NPV for project "standard" is $ Round to the nearest cent.

Data table

tableProbability of achieving cash inflow in given rangeRange of cash inflow $ millionsStandard Plant,Custom Plant$ to $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock