Question: QUESTION 4 P transfers voting common stock with a FMV of $80,000 and $20,000 of cash used to pay all of T's liabilities to T

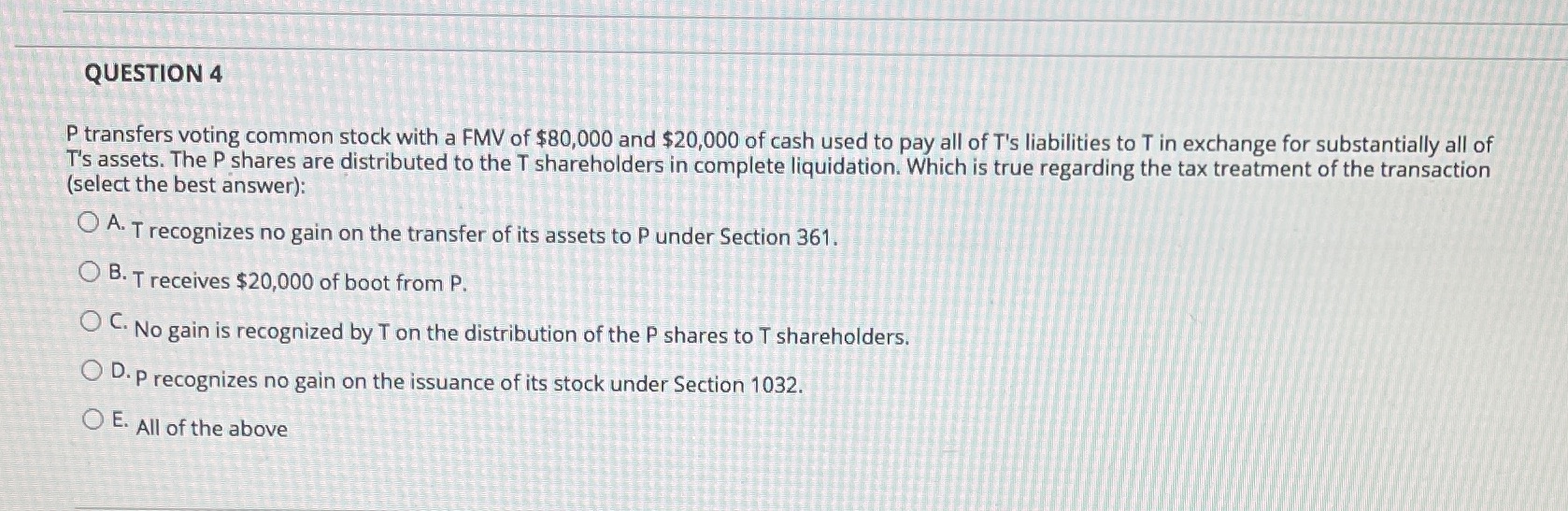

QUESTION 4 P transfers voting common stock with a FMV of $80,000 and $20,000 of cash used to pay all of T's liabilities to T in exchange for substantially all of T's assets. The P shares are distributed to the T shareholders in complete liquidation. Which is true regarding the tax treatment of the transaction (select the best answer): O A. T recognizes no gain on the transfer of its assets to P under Section 361. O B. T receives $20,000 of boot from P. O C. No gain is recognized by T on the distribution of the P shares to T shareholders. O D. P recognizes no gain on the issuance of its stock under Section 1032. O E. All of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock