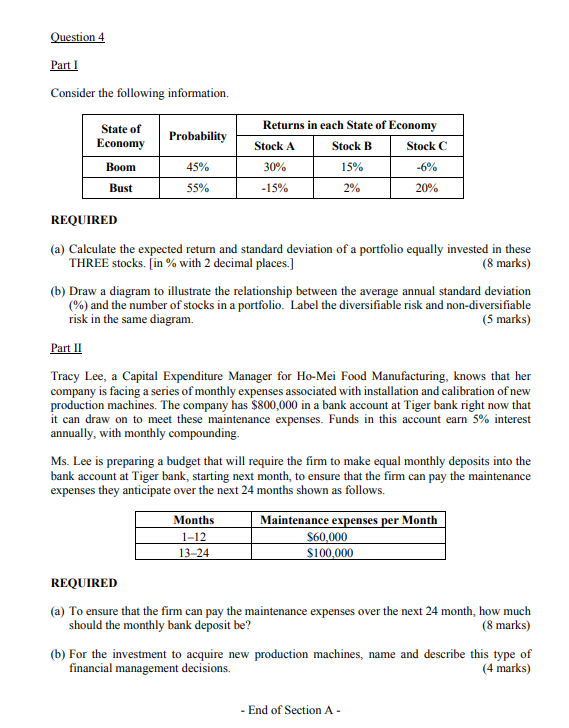

Question: Question 4 Part 1 Consider the following information. Probability State of Economy Boom Returns in each State of Economy Stock A Stock B Stock C

Question 4 Part 1 Consider the following information. Probability State of Economy Boom Returns in each State of Economy Stock A Stock B Stock C 45% 30% 15% -6% Bust 55% -15% 2% 20% REQUIRED (a) Calculate the expected return and standard deviation of a portfolio equally invested in these THREE stocks. (in % with 2 decimal places.] (8 marks) 6) Draw a diagram to illustrate the relationship between the average annual standard deviation (%) and the number of stocks in a portfolio. Label the diversifiable risk and non-diversifiable risk in the same diagram. (5 marks) Part II Tracy Lee, a Capital Expenditure Manager for Ho-Mei Food Manufacturing, knows that her company is facing a series of monthly expenses associated with installation and calibration of new production machines. The company has $800,000 in a bank account at Tiger bank right now that it can draw on to meet these maintenance expenses. Funds in this account earn 5% interest annually, with monthly compounding, Ms. Lee is preparing a budget that will require the firm to make equal monthly deposits into the bank account at Tiger bank, starting next month, to ensure that the firm can pay the maintenance expenses they anticipate over the next 24 months shown as follows. Months 1-12 13-24 Maintenance expenses per Month $60,000 $100,000 REQUIRED (a) To ensure that the firm can pay the maintenance expenses over the next 24 month, how much should the monthly bank deposit be? (8 marks) (b) For the investment to acquire new production machines, name and describe this type of financial management decisions. (4 marks) - End of Section A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts